In our experience at Merit Investment Bank & Co., we have found that there are three foundational elements that must be in place before we can apply a strategic approach to a successful M&A process for Entrepreneurs and CEOs.

When these three conditions align, we call it The Trifecta of M&A:

Market Timing – Are Market Conditions Favorable?

Financial Performance & Readiness (Corporate & Personal).

Personal Readiness – Mentally and emotionally are you ready to step away?

Market Timing

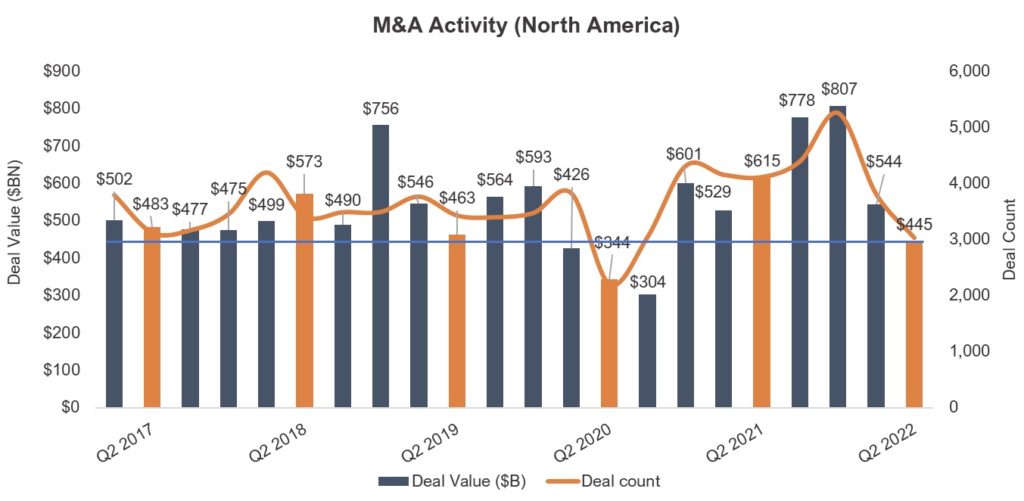

Market timing is the one area of the trifecta that the business owner does not have any control over. The good news, however, is that for most middle-market businesses, the current market is still strong. While a bit choppy with current geopolitical issues, inflation, lagging supply chain issues and the rising interest rate, environment sales happen in any market. Deal counts remain strong and lower middle market firms with revenues between $10MM-$250MM have not seen multiple compression like their publicly traded counterparts have.

Regardless of exogenous factors, achieving maximum value for your company requires preparation and continued execution of a value build and Value acceleration plan. By achieving “Exit Velocity,” (Growth and profitability increases achieved in the months leading up to a sale) will put more cash on the table for you at closing.

Financial Performance & Readiness.

To achieve an exit and preferably an outlier outcome, you need exit velocity where the following characteristics are met, and your performance outstrips that of your peers.

Outlier Outcomes typically have:

- A highly differentiated offering or Unique Value Proposition (UVP).

- Historical revenue growth above their peers (Sales and marketing performance).

- Historical EBITDA growth / margin above their peers (Financial and profit performance).

- Fully staffed and capable management team that will stay after closing of a transaction (Leadership).

- Defensible growth and expansion plan that the company has invested in. (Strategic and Initiative-taking market, sales process and operational execution, and realistic cap-ex plan).

- Good positioning and story compelling to Investors (most companies can’t tell their story well – focus on past vs. the future – need coaching and great knowledge of their customer journey)

- In a good tailwind sector (ICP identified, and markets poised for additional growth)

Take our quick Survey to determine your company’s exit readiness.

Personal Readiness

In addition to preparing the business for the transition, you must also prepare personally for a transition. For many, the cognitive and emotional shift experienced throughout the process may be even more impactful to your life than the transition itself.

- Do you have a compelling plan to spend time away from your business?

- Are you ready to push hard for 12-24 months to exit on top?

- Are you willing to trust others with your baby?

- Are you willing to share some of the spoils with your team?

- Are you willing to listen to your trusted advisors advice? Your spouse’s advice?

- Can you really golf 5 days a week?

With 75% of owners equating the sale of their business with retirement, those within 5 years of desiring an exit or retirement should spend considerable time preparing and assembling their value acceleration and exit team as for these entrepreneurs and CEO’s the stakes and their retirement satisfaction is at stake.

Sadly, many wait too long and miss their ideal window and find they still own their relatively illiquid private companies long after they wanted to exit by failing to personally prepare well.

Take a quick Retirement Readiness Survey to help you assess your retirement readiness

For more immediate action steps, you should take if you are ready to start considering an exit and to become personally and financially prepared, please see our article “Things to Do Right now if You’re Thinking About Selling”.

Reach out to discuss the best path for your company to grow or build generational wealth through the recapitalization or sale of your private company. 253-370-8893 | Craig.Dickens@meritinvestmentbank.com

Craig Dickens, CEO Merit Investment Bank

Craig is responsible for setting the firm’s vision, creating a culture of boutique personalized service, and recruiting experienced investment bankers to build the Merit Investment Bank team nationally and internationally. Mr. Dickens has advised many leading companies and participates on several middle-market company boards.

Having participated in every kind of business dynamic from start-up to IPO, merger to dozens of acquisitions in his own entrepreneurial career, Mr. Dickens serves clients by guiding them to strategic growth, business optimization, and profitable exit.

Merit Investment Bank is a leading boutique investment bank focused on entrepreneurial middle-market companies. Merit Investment Bank executes sell-side M&A, buy-side M&A, capital advisory services, debt and equity capital raises, corporate finance, and valuation services. www.meritinvestmentbank.com

0 Comments