During periods of uncertainty, there is what’s called “a flight to quality.” Understandably, buyers of middle-market companies, when faced with rising costs, market uncertainties, lingering supply chain issues, or recession, etc., inherently become more risk-averse when considering acquisition targets. Hence, a “flight” to quality assets ensues—which generally means these buyers are seeking to acquire clear market leaders.

What does this mean for sellers?

It means you want to make your company a “safe” investment.

In this climate, those companies featuring above-average financial performance are going to attract even more competition than they normally would, as well as higher multiples at sale. Additionally, any measures taken by the seller to de-risk or make the investment “safer” are going to be noticed and rewarded by buyers.

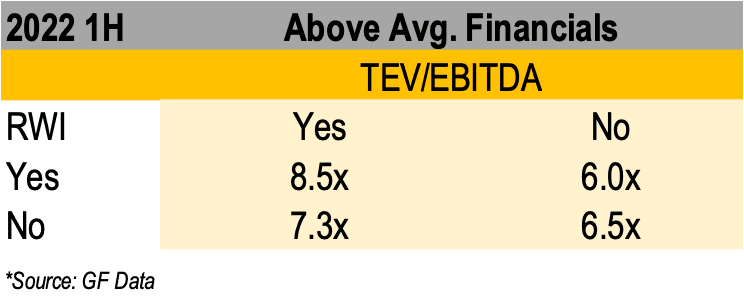

For example, 1H 2022 data suggests that, among private equity buyers, those companies with better financial performance did better than their peers (no surprise here). And those that elected to have Rep & Warranty Insurance (RWI) in place as part of the deal, shifting risk to insurance vs. the buyer or seller, did better still.

Making Your Company “the Best Deal”

There are a myriad of ways management teams can further position their company as a safe investment and solidify those future streams of cash flows that buyers covet.

During these flight to quality markets, a herd mentality among investors proliferates as they all move toward “safer” bets. So, what happens when more investors chase fewer “better quality” deals? Sellers of good companies get multiple offers, and the prices go up!

Outside of fundamental company performance and de-risking measures, there are several other considerations companies may want to pursue relative to an M&A process in order to bring better outcomes. If you are preparing for a liquidity event, here are a few suggestions:

1 . Positioning matters! Spend the time working with your I-banker to get the positioning of your deal right. We had a tech client we sold to a preemptive buyer that paid 20% above market value after another bank’s transaction failed because they did not get the positioning correct.

2 . Go broad. A broad auction approach to the sale of your company will ensure more buyers see your deal, and that you will be better able to take advantage of those buyers chasing the coveted high-quality deals.

3. Be prepared and know what you want. Have all information and diligence well-prepared in advance. Share critical information and your desires for what will occur post-transaction early in the process (e.g., would you like to stay on and work in the company, exit completely, stick around for consulting, etc.)

4. Move quickly. Ensure you and your banker are attuned to a quick and efficient process. As they say, “Time kills all deals.” Moreover, just as deer are especially skittish during hunting season, buyers during flight-to-quality markets can be spooked easily by delays.

5. Disclose, disclose, disclose. Ensure your banker discloses any issues that could erode trust or confidence in the deal. Buyers are looking for risks to pop out of the deal and the best way to handle that is to get ahead of it.

6. Secure and motivate key employees. Encourage them to go all in for the next chapter of the company’s evolution. Stay bonuses and other incentives can help ensure a stable management team post–transaction.

7. Pursue sell-side quality of earnings. Also consider some rigorous analytics for recurring revenue (ARR)-type businesses, etc.

We’re here to help. Reach out to discuss the best path for your company to grow or build generational wealth through the recapitalization or sale of your private company. 253-370-8893 | Craig.Dickens@meritinvestmentbank.com

Craig Dickens, CEO Merit Investment Bank

Craig is responsible for setting the firm’s vision, creating a culture of boutique personalized service, and recruiting experienced investment bankers to build the Merit Investment Bank team nationally and internationally. Mr. Dickens has advised many leading companies and participates on several middle-market company boards.

Having participated in every kind of business dynamic from start-up to IPO, merger to dozens of acquisitions in his own entrepreneurial career, Mr. Dickens serves clients by guiding them to strategic growth, business optimization, and profitable exit.

Merit Investment Bank is a leading boutique investment bank focused on entrepreneurial middle-market companies. Merit Investment Bank executes sell-side M&A, buy-side M&A, capital advisory services, debt and equity capital raises, corporate finance, and valuation services. www.meritinvestmentbank.com

0 Comments