Blogs

Discover the latest updates in the world of forward-thinking investment banking

M&A Education market I Strategic Advisory I Industry Insights I Selling a Business I Managing Risk I M&A I Owner Considerations

5 Reasons Why Most Business Owners Fail to Sell Their Companies

Who Really Benefits from the Sale of Your Company?

You do.

Monetizing your life’s work is a monumental moment—the crowning achievement for most CEOs and founders. But here’s the harsh truth: most businesses never sell. According to industry research, only about 20%–30% of companies that go to market actually transact. The rest quietly close their doors or liquidate their assets. Why? Often it’s due to poor preparation, unrealistic expectations, or lack of professional guidance.

If you’re fortunate enough to sell successfully, you join a minority of entrepreneurs who turned blood, sweat, and equity into real, generational wealth. So, who stands to gain from your successful exit? More people than you might think.

The Personal Rewards: Unlocking the Entrepreneurial Jackpot

As the business owner, you’re at the epicenter of benefit. But it goes far beyond a paycheck.

Top Rewards for Sellers:

Unlocking illiquid wealth trapped in your business

Eliminating stress tied to day-to-day operations, staffing, and crises

Minimizing personal liabilities or debt obligations

Diversifying your net worth away from a single business asset

Buying back your time—for passion projects, travel, or new ventures

Experiencing closure and fulfillment after years of building

Creating a personal legacy for your name, team, and industry

Expanding your generosity through charitable giving and impact investing

You’ve earned these rewards. You’ve risked everything—financially, emotionally, and physically—to create something of value. This isn’t just a transaction; it’s your victory lap.

Your Family Also Wins

Your family has likely been with you every step of the way—through the long nights, missed holidays, and the emotional rollercoaster of entrepreneurship.

How They Benefit:

More presence and peace: Your time and energy shift back to them.

Emotional payoff: They see your journey completed—and dreams realized.

A powerful life lesson: Kids witness the value of hard work, risk, and resilience.

Better lifestyle flexibility: Travel, education, and security options expand.

Generational opportunity: You may now be in a position to plan and fund a legacy that benefits generations to come.

And, yes, maybe even that once-distant cousin will start asking you for financial advice. 😉

Your Employees: A New Chapter Begins

If you’ve built a high-performing team, your exit can serve as a catalyst—not a conclusion.

Post-Sale Business Growth Often Includes:

Fresh leadership: New ideas and energy drive innovation.

Strategic capital: Private equity or strategic buyers often invest in growth.

Career advancement: Key team members may assume greater roles.

Cultural revitalization: A new chapter can energize the workforce.

Often, founders unintentionally create bottlenecks to innovation. With your exit, new leaders emerge, new products are launched, and old limitations are removed. Recognize and reward your key people—their loyalty and grit helped you get to this point.

The IRS: An Inevitable (but Manageable) Stakeholder

It’s no secret that Uncle Sam gets his slice. After years of tax deductions, depreciation, and write-offs, your exit likely triggers capital gains or income tax events. But here’s the good news: with proactive planning, much of this is manageable—and even optimizable.

Tax Planning Tips:

Start tax planning 1–2 years before a sale (not during due diligence)

Explore Qualified Small Business Stock (QSBS) and opportunity zones

Consider installment sales to defer taxation

Use trusts, gifting strategies, or charitable vehicles like donor-advised funds

Avoid the lazy mistake: Sellers who don’t plan pay far more than necessary

As they say, “Render unto Caesar what is Caesar’s—but not a penny more.”

Your Community: Your Success Multiplies Outward

When a founder sells successfully, it creates ripple effects that extend well beyond the boardroom.

Community-Level Impacts:

Philanthropy and giving back—from local sports fields to national causes

Expanded employment opportunities—especially if the business scales post-sale

Mentorship of future entrepreneurs

Funding local businesses or passion projects

Elevating your city or region as a hub for growth and innovation

Many business owners started with a desire to simply “do things differently” or escape the 9-to-5. But over time, their company became a vital piece of the community’s economic and cultural fabric. Don’t underestimate your impact—and take pride in what your business leaves behind.

So Why Do Most Business Owners Fail to Sell?

Despite all these benefits, most entrepreneurs don’t make it to the finish line. Here are the five leading causes of failed exits:

1. Unrealistic Valuation Expectations

Owners often overestimate their company’s worth, ignoring market trends, industry multiples, or operational risks.

2. Lack of Preparation or Clean Financials

Poor documentation, disorganized finances, or unresolved liabilities scare off serious buyers during due diligence.

3. No Succession Plan or Leadership Depth

If your business can’t run without you, it’s not sellable—it’s a job, not a company.

4. Emotional Attachments and Timing Conflicts

Many owners miss the window to sell because they’re too emotionally tied or wait until burnout, which weakens the business.

5. Failure to Engage Professional Advisors

Deals are complex. Without an experienced M&A team—especially a sell-side investment banker—you leave money on the table and increase the risk of a failed deal.

Exit Smart. Exit Well.

Whether your goal is financial freedom, legacy building, or simply a new chapter in life, a well-executed business sale is transformative. But it doesn’t happen by accident. It takes intentional planning, smart strategy, and trusted advisors.

4min

READ MORE

M&A I Sell side I Corporate Divestitures I Exit Planning I Restructuring & Special Situations

8 Transaction Killers and How to Avoid Them

You hired an investment banker and ran an effective process. You’ve received tons of interest, dozens of Indications of Interest near or above your expected closing price for your company, and you’re feeling pretty good right now. Unfortunately, this is where the real work begins, and the results are in your hands.

Once you’ve agreed to terms on a Letter of Intent (LOI), the buyer’s job is to validate that their thesis about your business is accurate. The thesis is based on the market, product, and the team’s ability to execute. That means that they want to know that what you told them is true. Anything that causes the buyer to doubt the information is potentially threatening to the deal.

Get your facts straight

First and foremost, make sure that the data you provided your banker with during the discovery phase of the relationship is accurate. It’s not uncommon for systems to not reconcile because accounting systems and operational systems are often used for different processes and reporting. Still, there should be a rational explanation for the discrepancies, and it should always be footnoted.

CFO

During the “selling phase” of the deal, the CFO’s responsibility is pretty light other than simply reporting on things they typically write on regardless. However, once the LOI is signed, the CFO’s responsibility goes into hyperdrive. Suppose the CFO didn’t correctly plan resources before this phase, their lack of ability to deliver will not only put their job in jeopardy after the transaction, but it will also delay the transaction, casting doubt on the team’s ability to execute.

Sales Traction

The buyer’s valuation and thesis are predicated on the company continuing to perform up to and through the transaction’s closing. A common mistake made in the process is to take your eye off the ball, especially when it comes to revenue. It’s easy to get consumed by the resource requirements of closing the deal. However, if you don’t have a hyper-focus on maintaining your current revenue rate and deliver on projected revenue, the buyer will think that something is systemically wrong with the business. This can kill a deal.

Technology Land Mines

If your business relies on technology or your product IS a technology product, there are several land mines that you must consider addressing before due diligence. If you wait until diligence begins, it will be too late to fix certain things. Many buyers are now contracting with “Technical Diligence” firms like Crosslake Technologies to do technical audits. The buyers recognize that they may be great at understanding the fundamentals of the financing or operations of a business, but technology is an entirely different language. Proactive technical diligence work can mean the difference between a clean closing and a deal getting flushed.

Customer Management

We had a deal last summer that brought this one home. The seller needed to sell for strategic reasons, yet the most significant customer was on the ropes for reasons unrelated to management. Businesses commonly sell for either a multiple of EBITDA (profit) or a multiple of Annual Revenue Rate (ARR). Regardless of which yours is, the loss or threatened loss of a strategic customer relationship will reduce revenue expectations and threaten a deal. At the very least, it will allow the buyer to retrade the deal at a lower valuation. Managing this customer relationship during the selling process is critical to the success of a transaction, especially if customer concentration is a lurking issue.

Hire the Experts

There are as many categories of attorneys as there are businesses. Just because someone has the title and is your friend doesn’t mean they should manage your transaction. I watched a deal almost get killed last fall due to a seller wanting to use their corporate attorney to run the transaction. We emplored them to use a reputable “deal attorney,” but they chose a friend of the corporate attorney who had been with them for years. Ultimately, the choice was a bad one. The mistake cost the seller hundreds of thousands of dollars in extra fees and created a credibility gap for the CEO due to poor judgment and decision-making.

The Tax Man

Several years ago, we were in the process of selling my first business. The deal looked great. A strategic buyer had submitted an LOI, and we were deep into diligence. Everything looked good, except the tax treatment of the deal became a sticking point in the transaction. Ultimately it got resolved; however, it was a great reminder that you need to consider the tax impacts of the deal and how it will affect you and the buyer. An appropriately-sized wealth manager working with a competent tax planner can be worth millions and can head off issues that could cause you to say no to a deal before you ever get there.

Expectations of Management

Nobody likes to be the “bad guy.” It’s also common for people to set optimistic expectations, especially entrepreneurs. The reality is, the process of diligence is stressful for everyone involved. If expectations about this aren’t communicated well in advance, some people may struggle to get through the process, sabotaging a deal. Ensure that everyone who needs to know is well-versed on what will happen in the process so they can plan for it in advance and keep the process on the rails.

At the end of the day, buyers will:

(1) trust that we’ve done our diligence on the company and won’t represent a company that we aren’t proud to represent

(2) trust the company to deliver on it’s promise.

If that trust is violated at any part of the process, the deal won’t get done. Every issue listed above ultimately comes down to trust and integrity in the process.

Want help with guiding the preparation process? A seasoned Investment Banker can help provide valuable insights on how your company can achieve exit velocity.

To arrange a confidential call to discuss how Merit Investment Bank helps companies and their leaders prepare for and achieve exit velocity please call Todd Ostrander, Managing Director @ 253-377-5767 or email Todd.Ostrander@meritinvestmentbank.com

4min

READ MORE

Industry Insights I M&A I M&A Education market

10 Questions For an Ideal Exit – Outlier Outcomes

Most owners of privately held business do not know if their business is sellable or what to do to achieve an Outlier Outcome at sale. An Ideal exit is one that is on your time, your terms and at your price.

In order to help you think about orchestrating your own Outlier Outcome, we offered some tips and observations in our three-part outlier outcomes series.

Companies that achieve “Outlier Outcomes” typically have:

1) Differentiation.

2) High Growth Rate.

3) Consistent Profitability.

4) Defensible Proforma and growth plan

5) Good Positioning.

6) Are in a good “Tailwind” Sector.

Please take a moment to answer 10 questions with a simple yes / no survey to help you get closer to an answer to what is takes to achieve an outlier outcome.

Do you feel you are a leader in terms of growth rate and profits vs. your peers?

Do you have a “rockstar” talented management team and could leave the business at sale without a discount?

Do you know the growth rate of your industry – are you leading, lagging, or neutral to your peers?

Is your largest customer under 15% of sales and your top 3 customers under 35%?

Is your CAC/LTV (or Gross Margin) leading or lagging in your industry?

In a crowded market of Baby Boomer sellers, can you truly articulate why your company is different?

Do you know your business’ value (Have you done a valuation?)

Do you know what number you need to retire or pursue your next chapter AFTER taxes? (Have you met with your CPA & Wealth Manager?)

Do you want to increase the value of your company whether you choose to sell or not?

Are you wanting to achieve a dream exit in under 3 years?

If you answered yes to 8 of the 10 questions above, you are ready for an ideal exit or Outlier Outcome!

If you answered yes to less than 8, we can help accelerate value and help you achieve an ideal or dream exit.

2min

READ MORE

Strategic Advisory I Business Valuation I Exit Planning I Selling a Business I Sell side

10 reasons why now is the right time to sell

Traditional wisdom touts that you should never attempt to “time the market,” but a preponderance of evidence suggests NOW is the best time to sell your company.

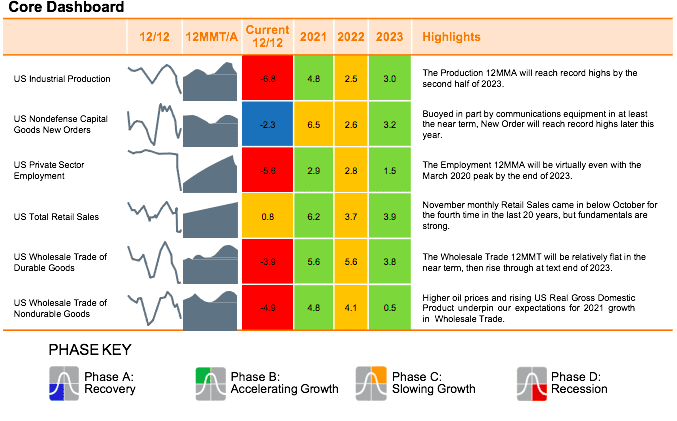

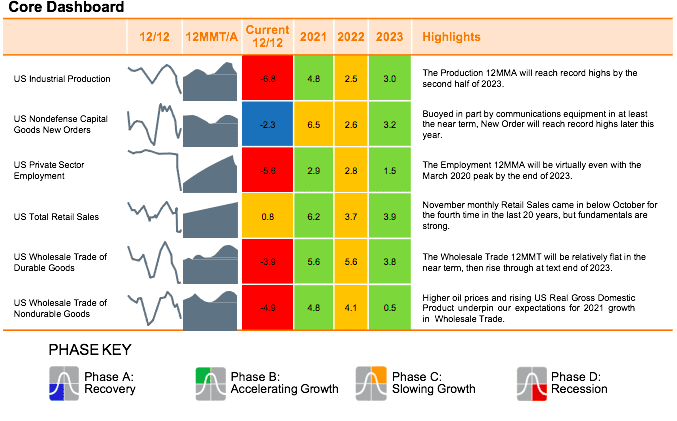

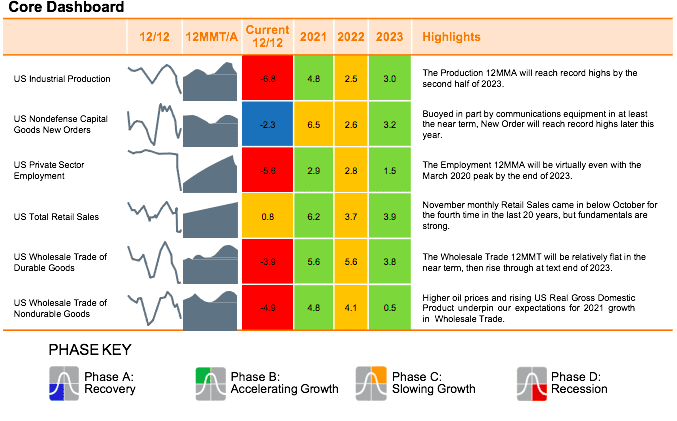

1. Economy

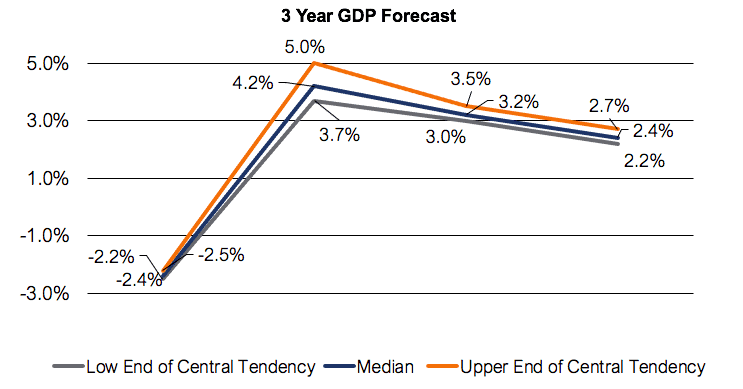

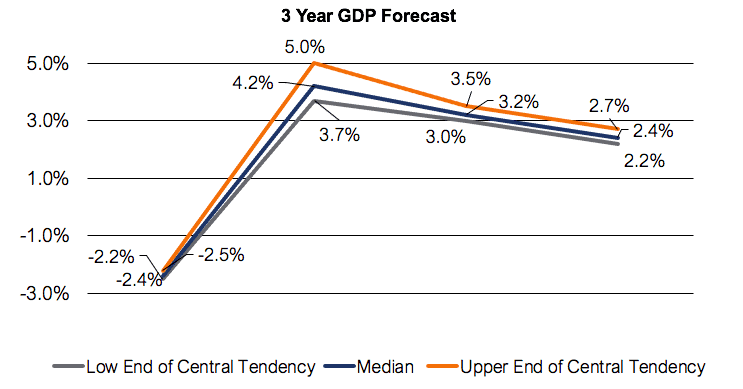

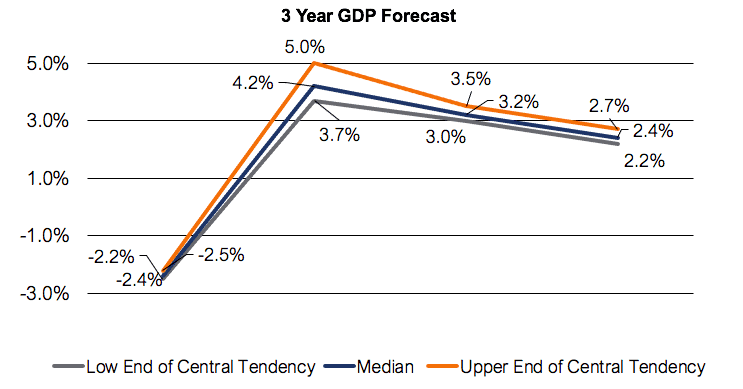

Post-COVID, the economy is rebounding. With a 6.6% GDP growth forecasted for 2021, GDP is predicted to return to a normalized historical level in 2022–2023. Companies 5x-20x your size are looking to grow by acquisition and take share. From The Fortune 500 to other competitive middle-market companies, acquisition as a growth strategy is on the mind of nearly all CEOs’ “To Do” lists.

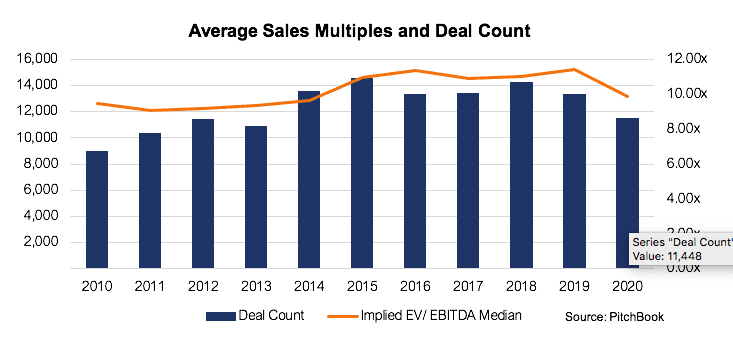

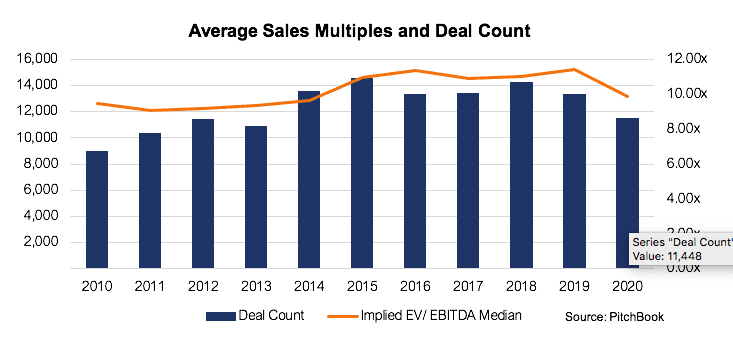

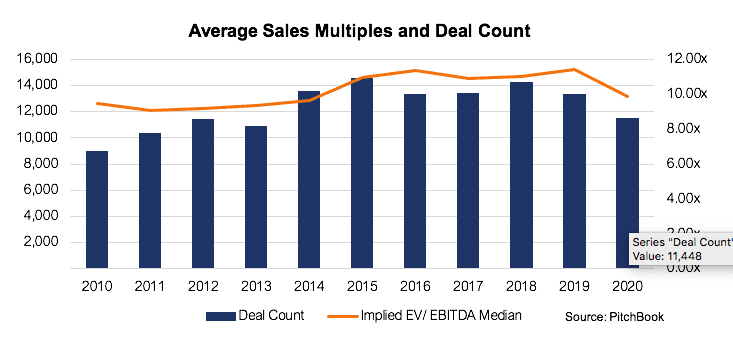

2. Sales Multiples

Quite surprisingly, sales multiples and values have held relatively stable through 2020. More money is chasing fewer “good deals” which is driving up prices for what we call premium companies. Many companies, historically trading in the 4x-6x EBITDA multiple ranges, are now trading for 7x-12x.

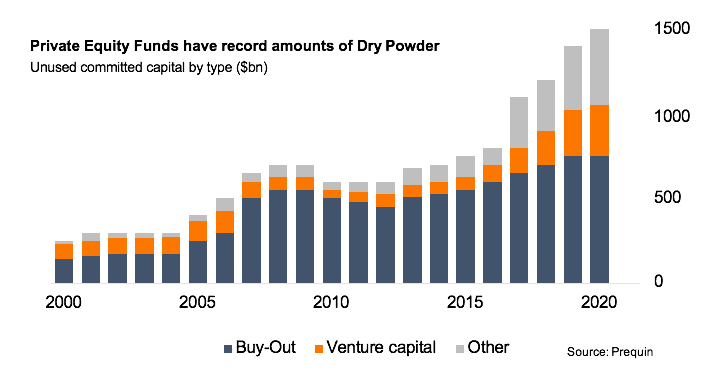

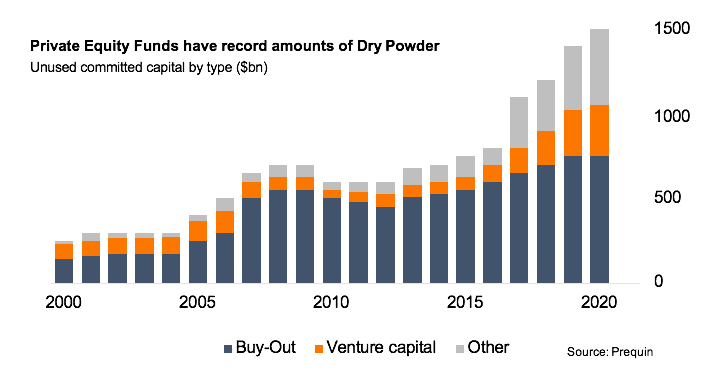

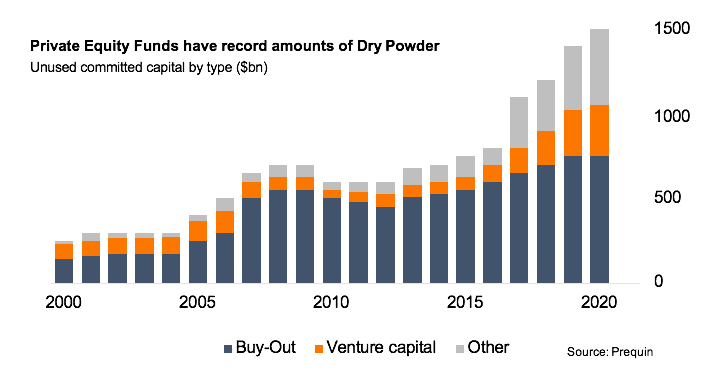

3. Private Equity Dry Powder (Cash)

Private Equity has close to $1.5 Trillion in Dry Powder (un-invested funds). Middle-market acquisitions have posted the largest increase in total investible funds raised from 2017 to 2020. With that much money chasing good companies like yours, it is no wonder that sale multiples have remained high.

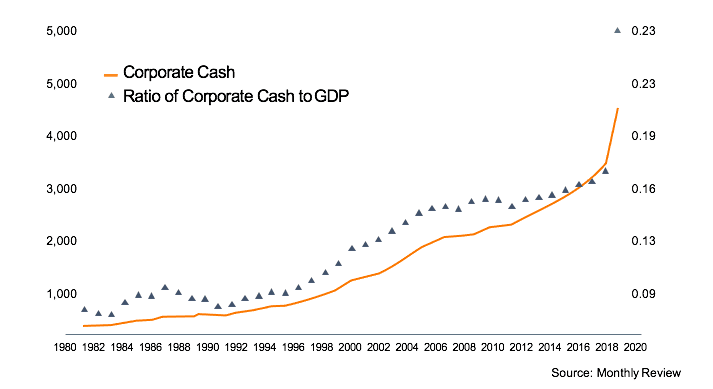

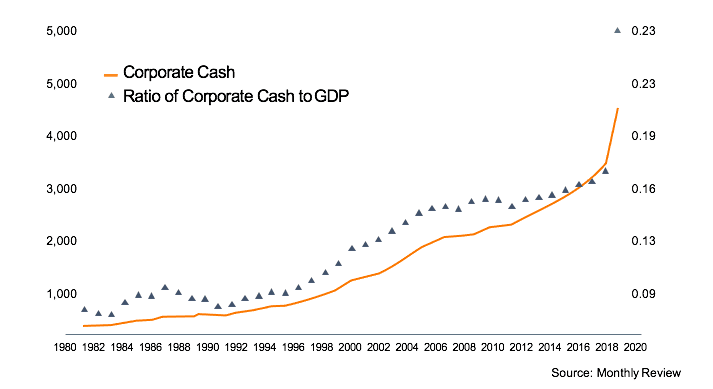

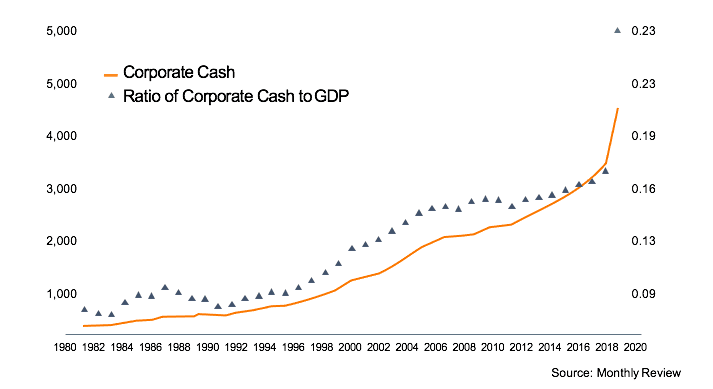

4. Strategics Stockpiling Cash

Not to be outdone, Fortune 500 and other strategic corporate buyers have historically speaking never had more cash on their balance sheets than now and are acquiring more companies for strategic reasons. Corporations are currently holding over $4 Trillion in cash to acquire target companies. “Buy vs. Build” is alive and well, putting cashback to use vs. distributing higher dividends back to shareholders.

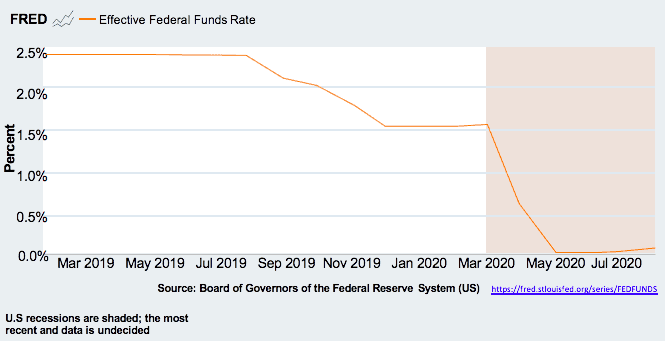

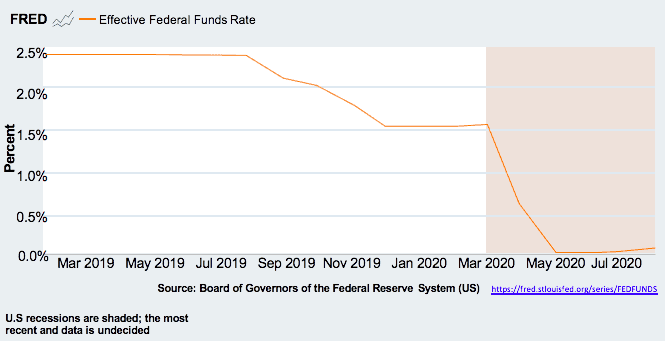

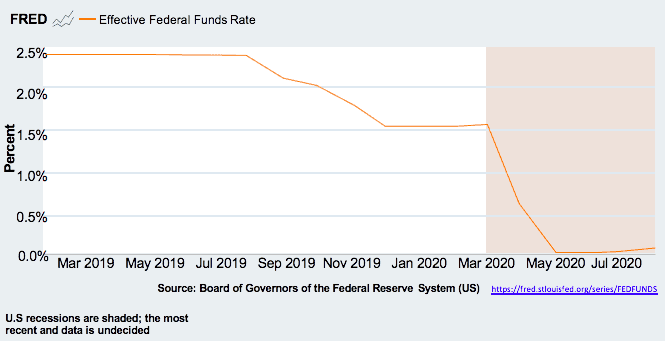

5. Historically Low-Interest Rates Benefit Sellers

Debt is almost always a part of Private Equity and corporate deal structures. Interest rates are at historic lows, and the Federal Reserve’s commitment to keeping them low through 2023 makes the cost of capital lower and M&A returns higher. Therefore, acquirers can afford to pay higher multiples and still achieve their desired ROI or ROIC.

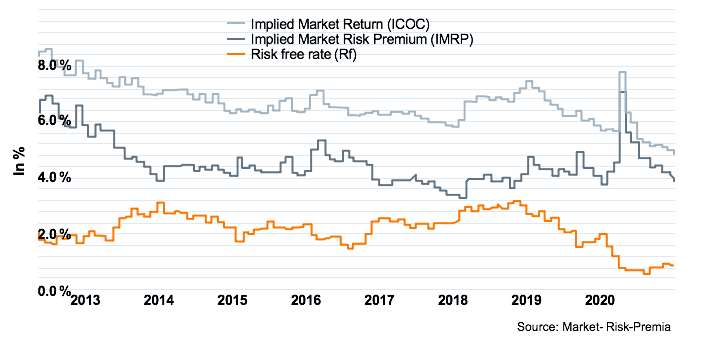

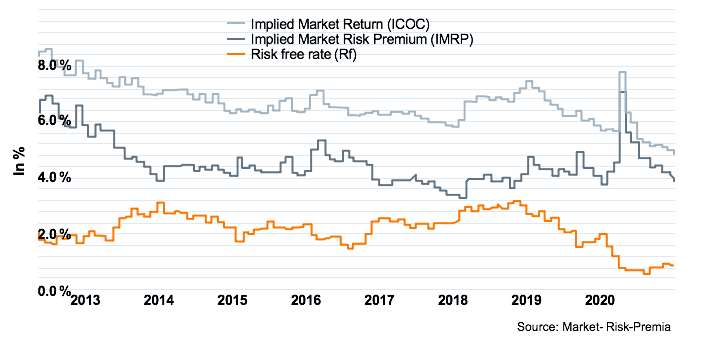

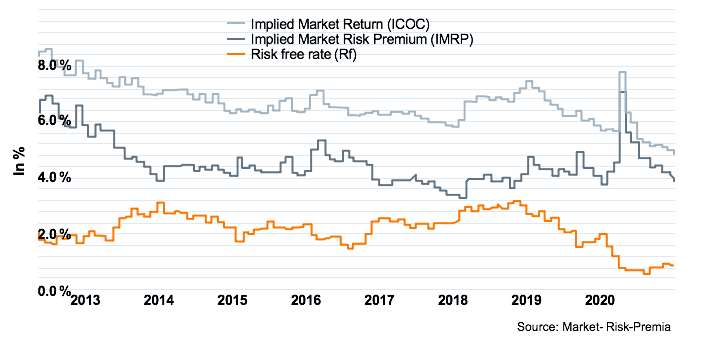

6. Risk Premiums Remain Low Aiding Benefit Sellers

The average market risk premium in the United States remained at 5.6% in 2020 despite the pandemic’s effects on the business community and economy in general. This suggests that investors demand a slightly higher return for investments in the US in exchange for the risk they are exposed to. This premium has hovered between 5.3% and 5.7% since 2011. Favorable US assets, GAAP accounting, and a large Total Addressable Market (TAM) in the US, coupled with the Federal Reserve’s efforts to keep inflation low, make for a strong M&A market in 2021 and beyond.

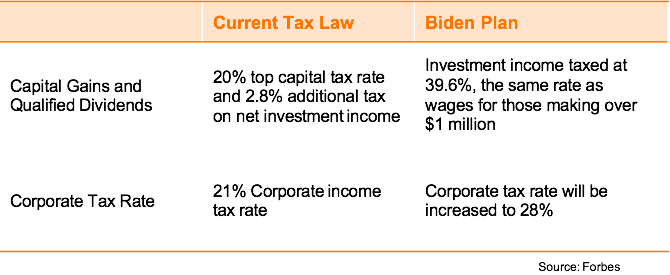

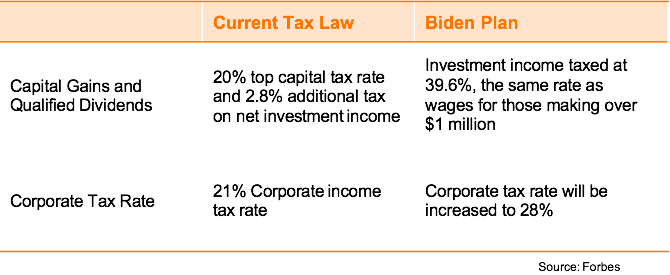

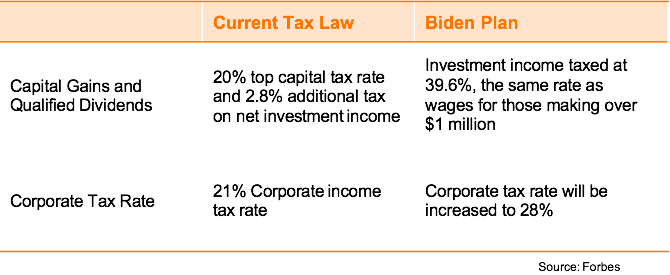

7. End of Low Corporate & Capital Gains Taxes

With the Biden administration’s promise of a higher personal tax rate and an increase in the capital gains rate, sellers will receive lower net-after tax proceeds from a sale. With the Senate split 50/50 with the democratic tiebreaker, it’s likely taxes will go up and to be the year to sell and avoid these tax increases.

8. Recession Survival

Perhaps having delayed the sale of your firm during the last recession and surviving the pandemic-triggered downturn, you are now weighing if you want to weather another downturn or take advantage of the post-pandemic recovery to sell. IRT Economics (our economic advisor with a 94.7% Forecasted Accuracy) highlights this unique time in our history. “The recession was not a usual, fundamentals-driven business cycle event, so we expect the economic recovery will be unusually robust. Businesses must therefore be opportunistic and seize on the unique elements currently at play. This cycle, the historical ‘recovery playbook’ will not be enough, and that is good news for firms that are willing to adapt to prosper.”

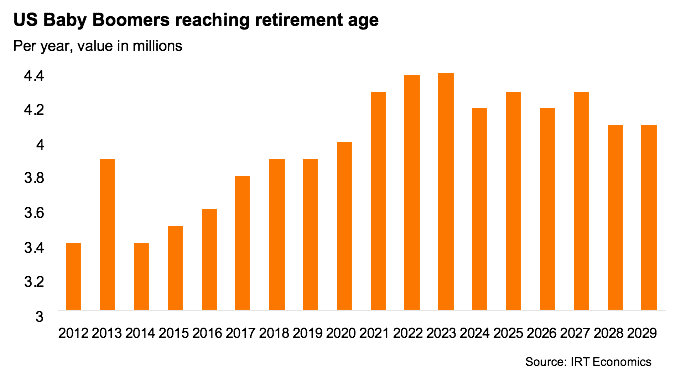

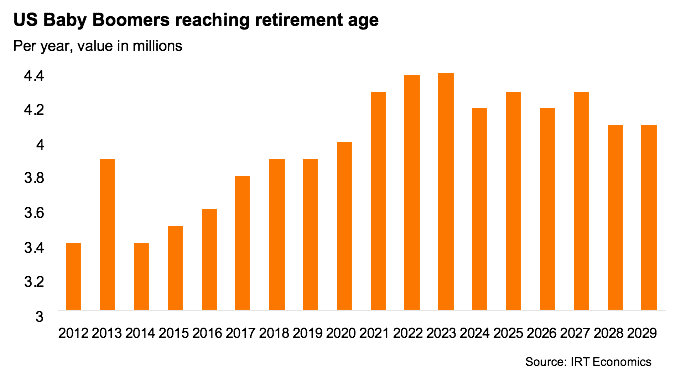

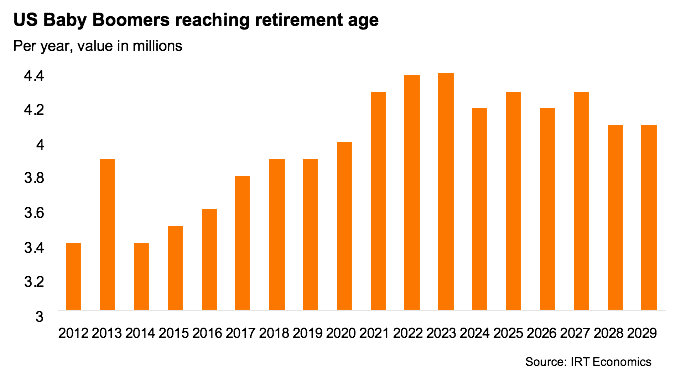

9. Baby Boomer Supply and Demand Issues

A glut of companies will be flooding the market as boomers (the most entrepreneurial generation) look to retire – supply and demand issues will have a real effect on market multiple, favoring only premium companies. In 2016, the first wave of boomers turned 70 (born 1946 – Post-WWII), followed by the successive three waves. Get ahead of the supply and demand curve. Again, you can’t control the fact that more companies will flood the market as baby boomers equate the sale of their business timing with retirement timing (75%), but you can profit from the knowledge of it.

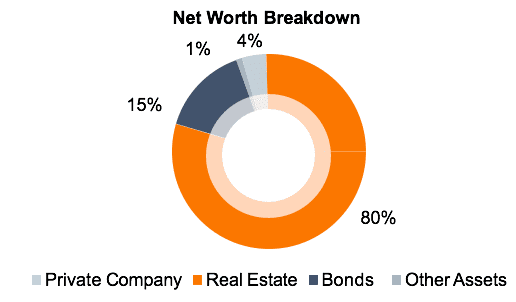

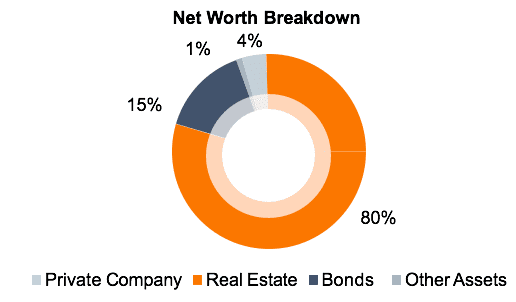

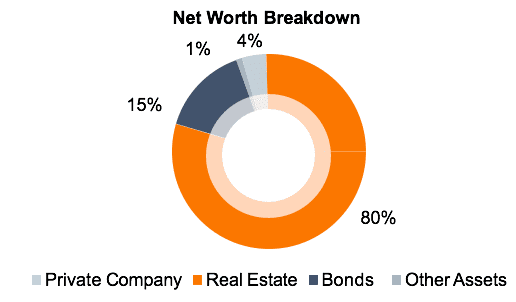

10. Diversification

It is said that most middle-market entrepreneurs have as much as 80% of their net worth tied up in their relatively illiquid private companies. Taking chips off the table, diversifying assets, and reducing associated risk is a wise strategy always, but perhaps more critical now, given the previously unimaginable impact of an event like COVID-19. If 2020 has taught us anything, it is being diversified helps mitigate risk. Who could have imagined the previous hot sectors of Aerospace, Hospitality, or Retail would have taken such a deep hit? Value is measured not only by what you have created but by how you have de-risked your entire portfolio.

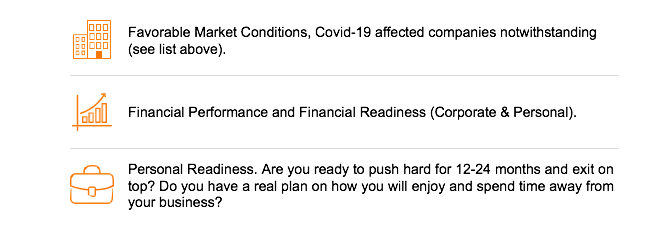

The Trifecta of M&A

This list would not be complete if we did not make a note on timing the market and what we call the “Trifecta of M&A.” While our comments above have an air of timing the market, recommending now as a good time to prepare and execute an M&A liquidity event, we are uniquely aware of the Trifecta of M&A, which is where these three conditions align:

Market conditions are currently and should continue to be frothy for the foreseeable future. Regardless of exogenous factors, achieving maximum value for your company requires preparation and continued execution of a rebuilding value plan or growth plan. Achieving exit velocity (growth achieved in the months leading up to a sale) will put more cash on the table for you at closing. In addition to preparing the business for the transition, you must also prepare mentally. For many, the cognitive and emotional shifts experienced throughout the process maybe even more impactful to your life than the transition itself.

Merit Investment Bank’s M&A advisors, investment bankers, and value enhancement teamwork as an integrated partner to help you create, build and grow value, and achieve readiness on all fronts.

When you are ready to exit, in your time and on your terms, our investment bankers can help you accelerate and capture value in a liquidity and exit process designed to meet your personal and business objectives. Why? Because your legacy matters!

Exit Well!

5min

READ MORE

Selling a Business I Sell side I Strategic Advisory I Business Valuation

10 Tips For Selling your Business

As a business owner, the last year has been quite a roller coaster, especially if you have been considering the sale of your business. Perhaps you had even started the process to go to market before the pandemic only to see the deal fall apart as uncertainty shut down almost all transactions. Many businesses went into survival mode for some time and, depending on the industry, may have even been forced to shut down. Others had the great fortune of being in an industry that benefitted from the economic changes or pivoted their business strategies quickly, leaving them in the best financial position they’ve ever experienced.

As the economy begins to open back up and business gets back up to speed, many of you are again thinking more about your financial future and getting back into a position to sell your company.

Other variables that have also been thrown into the mix are the potential tax law changes that could impact your profitability, valuation, and the net amount you keep from the sale.

With all of this noise and uncertainty, you may want to consider a thorough review of both your business and personal financial situation to see if your current strategies will bring you the outcomes expected, with what we call a “Stress Test.”

A Stress Test is a valuable process for business owners and affluent families with more complex financial situations seeking to grow, protect their business, wealth, and estate. A Stress Test can determine whether your financial planning strategies will deliver your desired results in various situations, environments, and current political climate. They can also identify potential mistakes, so proactive changes can be made to achieve the desired result and reach your goals.

A Stress Test is also a good idea if you’re considering an exit strategy. The test ensures you’re working with the right professionals to get the value you want and aren’t on the path to making any potential mistakes. Selling your business is a complex step. A Stress Test will target which areas your buyer will hone in on to negotiate price and allow your team to build a strategy for these areas that may need defending. Having the right deal team in place can make all the difference in getting the outcome you desire. The key members of this team should include your attorney, CPA, wealth manager, and investment banker.

Selling your business can be an overwhelming process and an emotional time. The motivating factor for selling can be as emotional as well. Whether you have built the business, it became tremendously successful, and now it’s time to move on, or if you’ve another venture in mind or perhaps retiring, this can be an exciting and sentimental time. Below are a few tips to help simplify the process that we emphasize in our stress testing process for owners thinking about a transaction:

1. Determine your business value

While a business is generally worth a multiple of its profit, there are a few other determining factors. The size of the deal or the industry can shift those multiples anywhere from 2 to 10 times the profit.

Unexpected circumstances do occur, and if this is a driving factor in the potential sale of the business, the process of selling has just become exponentially more stressful. No matter what drives the sale, the process is time-consuming, and there are several details you can’t afford to overlook.

2. Don’t Do This Alone

No matter your reasons for selling, your first step should be to bring in the experts. Financial, legal, tax, and wealth advisors are essential resources that ensure no detail is overlooked. A cohesive and collaborative wealth management team that has your back will make the process less stressful. It can also simplify and quiet the outside noise so that the end process is more satisfying and profitable.

Choosing professionals with experience in mergers and acquisitions is essential. It might be tempting to first turn to your long-time accountant or attorney, but if they don’t have the experience behind them to negotiate what’s best for you, it hurts only you in the end. Considerations when choosing your team should include:

Integrity

A sense of purpose and deep concern for their clients

Extensive technical expertise

Experience

Every good team needs a coordinator and a wealth manager with deal experience that is often the professional best suited to lead this group. The coordinator knows the client and their needs and brings in professionals with relevant skills specific to each client’s situation. The coordinator also takes care of follow-up and accountability, keeping in constant contact with the client and the cohesive financial team to ensure the highest professional standards are met, promises are delivered, and that the client is happy with the results.

A cohesive wealth management team working together to help you reach your goal will help you jump to the front of the line.

3. Silence is Golden

There are a few reasons to keep an impending sale quiet. Once you have finalized details of the deal, determine how to transition your customers to new ownership. If you release information too early, your customers may go into panic mode, or competitors may be able to swoop in.

4. Be seen, Increase visibility

To increase your chances of finding the best fit, an investment banker is an essential piece of the puzzle to give your business the highest market visibility. An investment banker will also assist you in setting a realistic price and contact potential buyers on your behalf. The best bankers focus on what is best for you, not on the outcome itself, and can make a significant difference in what may be the largest transaction you go through in your life.

5. Be realistic when setting the asking price.

Listen to your investment banker and deal team. It’s tempting to ask for a high price, but buyers will look at many factors when considering a purchase in reality. This is one reason a stress test that looks at all the same angles a potential buyer will see before you go to market is so crucial.

Financial trends, management team readiness, client relationships, and personal investment of time by the new owner to make a successful transition are considerations when setting your asking price.

6. Focus on the paperwork

Before you hang the for-sale sign, make sure all your paperwork is in order. Potential buyers want to peruse everything, including taxes, financials, and existing contracts involving your business. The process will be much smoother if you’re organized. Include financial and tax records for the past three years and a cash flow report.

7. Separate business and personal

Business owners running personal expenses through the business now and then is a common practice. Potential buyers need an accurate and clear view of the revenue, expenses, and net profit of your business. Now is the time to ensure everything is separate and stays that way to the finish line.

8. Get it in writing

Price alone may not be the only factor to consider. In order to make accurate comparisons of multiple offers, it’s helpful to have them in writing with all the terms and conditions spelled out. Recording the details of each offer can ultimately determine which is the best fit for you.

9. First impressions count

If you have a brick and mortar, make sure it’s clean, all necessary repairs are made, and all equipment is in working order. Curb appeal is essential. In addition, make sure your team has prepared for the presentation with potential buyers, including reviewing the likely questions and how you will approach the answers.

10. It’s all in the details

Tie up your loose ends, big and small. Make sure all payments are up to date, and if you’ve promised shares in the company to a team member, the time to take care of this is now. Loose ends can cause potential problems as you’re trying to complete the deal.

This list of tips is not exhaustive; however, it is a good starting point as you consider the future sale of your business.

The key is, you are not alone in this process! Working with the right team will ensure you’re prepared before your business goes to market. You will be set up for success and increase your chances of finding the right buyer and the price.

While every business would benefit from a Stress Test, if you are considering the sale of your company, now is the time to complete a process like this and begin to think about the right team you will want to have around you.

If you are interested in learning more about how we help our business owner clients prepare for the most important decisions of their lives, please reach out to me at

homer@konvergentwealth.com

Homer Smith is a Private Wealth Advisor with Konvergent Wealth Partners and is a separate entity from Merit Investment Bank & Company.

Investment advice is offered through Integrated Financial Partners, a registered investment advisor. Integrated Financial Partners provides investment advisory services through several doing-business-as names. The information in this material is for general information only and is not intended to provide specific advice or recommendations for any individual. Integrated Financial Partners does not provide legal/tax/mortgage advice or services. Please consult your legal/tax advisor regarding your specific situation.

6min

READ MORE

Sell side

12-Month Exit Prep Checklist

Month 1–2: Define Strategy & Goals

Objective: Establish clarity around owner goals, value drivers, and readiness.

☐ Conduct an Owner Readiness Assessment – define financial, lifestyle, and legacy goals.

☐ Engage Merit Investment Bank advisors to develop an Exit Strategy Blueprint.

☐ Identify key value drivers and risks (customer concentration, scalability, IP, etc.).

☐ Commission a preliminary valuation to benchmark current enterprise value.

☐ Align leadership and stakeholders on target outcomes, deal structure preferences, and timeline.

☐ Begin documentation audit – organize financials, corporate records, and legal agreements.

Month 3–4: Optimize Financial & Operational Systems

Objective: Prepare the business to withstand buyer due diligence and maximize valuation.

☐ Clean up accounting: ensure GAAP compliance, accurate P&L, and reconciled balance sheets.

☐ Finalize 12–24-month financial forecasts supported by validated assumptions.

☐ Review and optimize working capital management (AR, AP, inventory).

☐ Eliminate non-essential or discretionary expenses to enhance EBITDA.

☐ Ensure contracts and vendor agreements are current and transferable.

☐ Evaluate IT infrastructure, data security, and system scalability.

Month 5–6: Strengthen Management & Governance

Objective: Build buyer confidence through leadership stability and succession readiness.

☐ Identify critical managers; develop retention or incentive plans.

☐ Clarify governance and decision-making structures.

☐ Document key operational procedures and workflows.

☐ Create an organizational chart highlighting post-sale continuity.

☐ Assess HR policies, benefits, and compliance posture.

☐ Begin grooming potential successors or secondary leadership layers.

Month 7–8: Accelerate Growth & Value Drivers

Objective: Drive momentum and highlight performance before the sale process.

☐ Implement Grow Fast & Exit Profitably® initiatives: boost revenue velocity and margin.

☐ Introduce new product/service lines or expand recurring revenue.

☐ Strengthen brand positioning and market awareness.

☐ Collect client testimonials and case studies for the buyer data room.

☐ Review pricing models and customer contracts to ensure sustainability.

☐ Address customer concentration—diversify where possible.

Month 9–10: Transaction Preparation

Objective: Build the foundation for a seamless deal execution.

☐ Finalize Quality of Earnings (QoE) and normalized financial statements.

☐ Establish a Digital Data Room for diligence documentation.

☐ Prepare Confidential Information Memorandum (CIM) with Merit advisors.

☐ Align with legal counsel on deal terms, indemnifications, and representations.

☐ Conduct internal “mock due diligence” to anticipate buyer questions.

☐ Finalize tax and estate strategies with CPA and wealth advisors.

Month 11–12: Go-to-Market & Close Preparation

Objective: Enter the market confidently and close under optimal terms.

☐ Launch buyer outreach through Merit’s M&A process (strategic, PE, and international).

☐ Review and qualify multiple LOIs to maintain competitive tension.

☐ Conduct management presentations and site visits.

☐ Negotiate deal structure: cash, rollover equity, earnouts, or seller financing.

☐ Plan internal and external communications for post-closing transition.

☐ Prepare reinvestment or liquidity strategy post-sale.

☐ Celebrate responsibly — then transition to Post-Sale Planning.

2min

READ MORE

M&A I M&A Education market I Strategic Advisory

20 Questions Prospective Buyers Ask

Before you put your business up for sale, you need to be prepared to evaluate its status from a number of different perspectives besides your own.

Much of what you know about your own company is from your own experience, looking back over what you have accomplished. After all, it has consumed your time, your energy, your passion, and who knows what else for who knows how long!

Your buyer, on the other hand, is looking at your company from a completely different perspective: looking forward, what will this company do for them? With this in mind, prospective buyers are going to want to conduct a careful examination of all aspects of your business, both negatively and positively.

Every business is unique, with its own risk factors and opportunities. Your prospective buyer’s goal is to be able to structure a deal in their own best interests that will maximize the upsides and minimize the downsides of your company. To accomplish this, the buyer will want to ask questions—lots of questions—about how your business operates. You’ll want to respond honestly, with an aim to inform, not impress. If you try to oversell it, they will no doubt find out in due time through due diligence.

You can be prepared in advance for the kinds of questions they’re going to ask. Whether buyers’ considerations are financial or strategic, most have a set of gating questions they want to know about a company, before even considering it for an acquisition.

Here are the top 20 topics on a buyers’ mind (read through to the end and then take our quiz to see how your company stacks up!):

Profits

Revenue growth

Stability

Market share in your niche

Customer retention

Customer concentration

Competition

Overhead and expense controls and budget history

Product/market obsolescence

Cap-ex

Capital Efficiency

Management team strength

Regulatory environment

Environmental risks

Maintenance of IP

Social or cultural issues

Planning Processes

Corporate governance

Operating and financial metrics

Dealing with technological change

Now, if you want to see if you would make it to the next level of serious buyer interest, take our quiz and get your score.

2min

READ MORE

Industry Insights I M&A I Owner Considerations I Business Valuation

Absolute or Relative Earn-Outs in M&A Deals

What Is an Earn-Out in M&A? How It Works and When to Use It

In a mergers and acquisitions (M&A) deal, an earn-out is a contractual arrangement between the buyer and the seller that allows the seller to receive additional compensation after the closing—typically tied to the business hitting certain future performance targets. This deferred payment is often based on achieving specific milestones related to revenue, EBITDA, gross profit, or even operational goals like customer retention or product development.

The structure is increasingly popular in today’s uncertain economic climate, offering a flexible way to bridge valuation gaps, share risk, and create alignment between both parties.

Why Use an Earn-Out? Bridging the Valuation Gap

Earn-outs are most commonly used when buyers and sellers can’t agree on a firm purchase price. Rather than walking away, they build a structure that rewards the seller for future performance and protects the buyer from overpaying.

Example: A buyer offers $40 million upfront, with an additional $10 million available over two years if the company reaches $12 million in EBITDA. This way, both sides find common ground.

This shared-risk model ensures sellers have a continued incentive to perform post-sale, while buyers can better manage downside risk—especially in volatile or recession-prone industries.

Market Trends: Earn-Out Usage Is Rising

In today’s market, with increased deal scrutiny, recession fears, and market volatility, earn-outs are being used more frequently. Recent studies suggest that 17% to 26% of middle-market transactions include some form of contingent compensation or performance-based payout.

This trend is particularly pronounced in sectors with high growth uncertainty—like technology, healthcare, and consumer products—where future performance is difficult to predict, but growth potential is high.

How Do Earn-Outs Work?

There are two primary structures for earn-outs:

1. Absolute Earn-Outs

These are based on hard, quantifiable financial goals. For example:

$1 million additional payout if revenue reaches $25 million in Year 1

$3 million payout if EBITDA surpasses $5 million in Year 2

These are easier to measure and enforce, making them more common in private equity-backed deals or where financial reporting is consistent and transparent.

2. Relative Earn-Outs

These are based on more subjective or operational metrics, such as:

Customer satisfaction scores

Market share increases

Retention of top clients or key employees

Launching a new product within a defined time frame

While harder to define and track, relative earn-outs can align better with strategic growth objectives and offer more flexibility.

Key Elements of a Strong Earn-Out Agreement

To ensure the earn-out doesn’t become a source of dispute, the agreement should include:

Clear and measurable benchmarks (e.g., GAAP-based EBITDA, audited revenue)

Defined time periods for measurement (usually 1–3 years post-closing)

Governance rules around decision-making and capital expenditures during the earn-out period

Transparency clauses that allow the seller to access performance data

Dispute resolution mechanisms, such as neutral third-party accounting reviews

Risks and Pitfalls: What to Watch Out For

While earn-outs can offer a win-win, they are not without risk. Common challenges include:

Post-sale control changes: Sellers may lose operational control, limiting their ability to achieve targets.

Accounting manipulation: Buyers might defer revenue or increase expenses to avoid triggering earn-out payments.

Disputes over definitions: EBITDA or net income can be interpreted in various ways depending on the accounting method.

Misaligned incentives: The seller might prioritize short-term earnings to maximize payouts, which may not align with the buyer’s long-term strategy.

Negotiating a Fair Earn-Out

Smart earn-out negotiations consider more than just financial metrics. Some key tips include:

Limit the duration: One to three years is standard. Longer periods create more complexity.

Include caps and floors: Set minimum and maximum payouts to define the upside and downside.

Use multiple metrics: Combining revenue and EBITDA or including operational goals adds balance.

Protect the earn-out: Consider a role for the seller post-close (e.g., President or Advisor) to preserve influence over outcomes.

Real-World Example

Let’s say a SaaS company sells for $20 million upfront, with an additional $5 million contingent on ARR (Annual Recurring Revenue) reaching $15 million within 18 months. The seller, who stays on as CTO, has access to performance dashboards and quarterly performance reports to track progress.

Both sides agree that if ARR hits $13 million, the payout is reduced proportionally. This ensures alignment while acknowledging potential macroeconomic headwinds.

Final Thoughts: Are Earn-Outs Right for You?

Earn-outs are powerful tools in deal structuring, especially when used thoughtfully. They allow for:

Deal completion in tough valuation environments

Continued seller participation post-transaction

Protection for buyers against underperformance

But they must be carefully constructed with clear terms, mutual trust, and sound legal advice to avoid post-close friction.

At Merit Investment Bank, we help founders navigate the complexities of earn-outs and other performance-based deal structures. Whether you’re considering a partial exit or full sale, we guide you to protect value, minimize risk, and structure a deal that supports long-term success.

4min

READ MORE

M&A I M&A Education market

Beware of the Preemptive Offer

As a business owner, you’ve likely encountered calls and emails from firms claiming to have buyers ready to purchase your business or introducing you to potential strategic relationships. Private Equity Groups (PE), as well, may be reaching out, touting their ability to offer a differentiated buying experience. It’s flattering, and sometimes, the attention feels great.

But don’t let the preemptive offer catch you off guard. In fact, it could cost you money.

Beware of the Preemptive Offer: Why Competition Matters in Selling Your Business

While many entrepreneurs are enticed by the idea of a quick sale without competition, this is a classic mistake. The real value in selling your business comes when you’ve created a competitive environment that drives up the price and ensures you’re making the best deal possible. It’s all about embracing the auction mindset.

The Problem with Preemptive Offers

It might feel tempting to accept a preemptive offer—especially when it comes from a company that seems genuinely interested in your business. However, these unsolicited offers are often made with the intention of securing a sale without competition, which can leave you leaving money on the table.

Sure, the offer may seem attractive, but how can you be sure it’s the best possible deal without considering all your options? This is why creating a competitive auction environment is essential for maximizing your sale price and protecting your interests.

Early Lessons from My First Business

Let me explain how I first encountered the preemptive offer—and why it’s crucial to create competition when selling your company. Shortly after college, I launched a mail-order distribution company called SBR Sports (Swim Bike Run Sports). It was born from my passion for triathlons, which was expensive, but I quickly realized the potential to make money by catering to fellow triathletes with discretionary income.

In the mid-80s, the triathlon market was growing, and we created a niche brand that was catching attention. However, the traditional cycling industry was late to recognize the rise of triathlon as a serious sport. They were cycling purists who initially dismissed triathletes, but as our market grew, they saw an opportunity to buy into a market they had neglected.

I received my first unsolicited offer from a competitor—Strategic #2. They made a strong pitch, flattering us on our growing brand presence and positioning within the market. However, something about the offer felt too good to be true.

Turning the Tables: The Auction Mindset

Instead of jumping at the preemptive offer, I reached out to Strategic #1, a competitor who had been watching our growth but hadn’t approached us yet. After evaluating the initial offer, we realized that Strategic #1 was willing to offer significantly more—2.4 times the initial preemptive offer, and after a little negotiation, the price climbed to 2.7 times.

This wasn’t a “dot-com” exit, but for two 25-year-olds, it was a fantastic outcome. The lesson here? Competition creates value. By leveraging a competitive auction mindset, I forced the market to show me its true value, and it paid off.

Why the Auction Mindset is Key in Business Sales

The core takeaway from my experience is that competition increases the value of your business. Instead of being swept up in the rush of a preemptive offer, you should actively seek multiple buyers and create an environment where they compete for your company. Here’s why:

Market Clarity: When multiple buyers are involved, they’ll each bring their own set of strengths and weaknesses to the table. This helps you identify the best fit for your business, whether you’re looking for cash upfront, long-term strategic partnership, or other deal structures.

Driving Value Up: Having more than one party interested in your business naturally increases its perceived value. Buyers will often offer higher amounts when they know they’re not the only option.

Keeping Negotiations Honest: With multiple buyers, the negotiation process is more transparent. It keeps the buyers honest and prevents any one buyer from undervaluing your business or imposing unreasonable terms.

More Control: The auction mindset gives you more control over the sale process. You can dictate the terms of the deal, such as the structure (cash, rolled equity, earn-outs, or seller notes), which allows you to align the deal with your financial and personal goals.

Preemptive Offers: When Should You Consider Them?

While competition is crucial, there may be rare circumstances when accepting a preemptive offer makes sense. For example:

If the buyer is offering premium value and is a clear fit for your business.

If you are in a time-sensitive situation and need liquidity quickly.

If you want to minimize risk and ensure a smooth transition with a buyer you trust.

However, these situations should be the exception, not the rule. In most cases, creating a competitive landscape is the best way to maximize the value and terms of the deal.

Conclusion: Don’t Settle for Less Than Your Business Is Worth

The lesson I learned from my first exit is clear: Never settle for a preemptive offer without testing the market and seeking multiple buyers. By creating competition, you can ensure that you’re getting the best possible deal. The auction mindset isn’t just a tactic—it’s a strategy that ensures your business is sold for the price it deserves.

If you’re considering selling your company, let us help you cultivate the auction mindset and navigate the M&A process with confidence. Don’t let an unsolicited offer dictate your exit strategy. Get the best price, the best terms, and the best deal for your business.

4min

READ MORE

M&A Education market I Strategic Advisory I Industry Insights I Selling a Business I Managing Risk I M&A I Owner Considerations

5 Reasons Why Most Business Owners Fail to Sell Their Companies

Who Really Benefits from the Sale of Your Company?

You do.

Monetizing your life’s work is a monumental moment—the crowning achievement for most CEOs and founders. But here’s the harsh truth: most businesses never sell. According to industry research, only about 20%–30% of companies that go to market actually transact. The rest quietly close their doors or liquidate their assets. Why? Often it’s due to poor preparation, unrealistic expectations, or lack of professional guidance.

If you’re fortunate enough to sell successfully, you join a minority of entrepreneurs who turned blood, sweat, and equity into real, generational wealth. So, who stands to gain from your successful exit? More people than you might think.

The Personal Rewards: Unlocking the Entrepreneurial Jackpot

As the business owner, you’re at the epicenter of benefit. But it goes far beyond a paycheck.

Top Rewards for Sellers:

Unlocking illiquid wealth trapped in your business

Eliminating stress tied to day-to-day operations, staffing, and crises

Minimizing personal liabilities or debt obligations

Diversifying your net worth away from a single business asset

Buying back your time—for passion projects, travel, or new ventures

Experiencing closure and fulfillment after years of building

Creating a personal legacy for your name, team, and industry

Expanding your generosity through charitable giving and impact investing

You’ve earned these rewards. You’ve risked everything—financially, emotionally, and physically—to create something of value. This isn’t just a transaction; it’s your victory lap.

Your Family Also Wins

Your family has likely been with you every step of the way—through the long nights, missed holidays, and the emotional rollercoaster of entrepreneurship.

How They Benefit:

More presence and peace: Your time and energy shift back to them.

Emotional payoff: They see your journey completed—and dreams realized.

A powerful life lesson: Kids witness the value of hard work, risk, and resilience.

Better lifestyle flexibility: Travel, education, and security options expand.

Generational opportunity: You may now be in a position to plan and fund a legacy that benefits generations to come.

And, yes, maybe even that once-distant cousin will start asking you for financial advice. 😉

Your Employees: A New Chapter Begins

If you’ve built a high-performing team, your exit can serve as a catalyst—not a conclusion.

Post-Sale Business Growth Often Includes:

Fresh leadership: New ideas and energy drive innovation.

Strategic capital: Private equity or strategic buyers often invest in growth.

Career advancement: Key team members may assume greater roles.

Cultural revitalization: A new chapter can energize the workforce.

Often, founders unintentionally create bottlenecks to innovation. With your exit, new leaders emerge, new products are launched, and old limitations are removed. Recognize and reward your key people—their loyalty and grit helped you get to this point.

The IRS: An Inevitable (but Manageable) Stakeholder

It’s no secret that Uncle Sam gets his slice. After years of tax deductions, depreciation, and write-offs, your exit likely triggers capital gains or income tax events. But here’s the good news: with proactive planning, much of this is manageable—and even optimizable.

Tax Planning Tips:

Start tax planning 1–2 years before a sale (not during due diligence)

Explore Qualified Small Business Stock (QSBS) and opportunity zones

Consider installment sales to defer taxation

Use trusts, gifting strategies, or charitable vehicles like donor-advised funds

Avoid the lazy mistake: Sellers who don’t plan pay far more than necessary

As they say, “Render unto Caesar what is Caesar’s—but not a penny more.”

Your Community: Your Success Multiplies Outward

When a founder sells successfully, it creates ripple effects that extend well beyond the boardroom.

Community-Level Impacts:

Philanthropy and giving back—from local sports fields to national causes

Expanded employment opportunities—especially if the business scales post-sale

Mentorship of future entrepreneurs

Funding local businesses or passion projects

Elevating your city or region as a hub for growth and innovation

Many business owners started with a desire to simply “do things differently” or escape the 9-to-5. But over time, their company became a vital piece of the community’s economic and cultural fabric. Don’t underestimate your impact—and take pride in what your business leaves behind.

So Why Do Most Business Owners Fail to Sell?

Despite all these benefits, most entrepreneurs don’t make it to the finish line. Here are the five leading causes of failed exits:

1. Unrealistic Valuation Expectations

Owners often overestimate their company’s worth, ignoring market trends, industry multiples, or operational risks.

2. Lack of Preparation or Clean Financials

Poor documentation, disorganized finances, or unresolved liabilities scare off serious buyers during due diligence.

3. No Succession Plan or Leadership Depth

If your business can’t run without you, it’s not sellable—it’s a job, not a company.

4. Emotional Attachments and Timing Conflicts

Many owners miss the window to sell because they’re too emotionally tied or wait until burnout, which weakens the business.

5. Failure to Engage Professional Advisors

Deals are complex. Without an experienced M&A team—especially a sell-side investment banker—you leave money on the table and increase the risk of a failed deal.

Exit Smart. Exit Well.

Whether your goal is financial freedom, legacy building, or simply a new chapter in life, a well-executed business sale is transformative. But it doesn’t happen by accident. It takes intentional planning, smart strategy, and trusted advisors.

4min

READ MORE

M&A I Sell side I Corporate Divestitures I Exit Planning I Restructuring & Special Situations

8 Transaction Killers and How to Avoid Them

You hired an investment banker and ran an effective process. You’ve received tons of interest, dozens of Indications of Interest near or above your expected closing price for your company, and you’re feeling pretty good right now. Unfortunately, this is where the real work begins, and the results are in your hands.

Once you’ve agreed to terms on a Letter of Intent (LOI), the buyer’s job is to validate that their thesis about your business is accurate. The thesis is based on the market, product, and the team’s ability to execute. That means that they want to know that what you told them is true. Anything that causes the buyer to doubt the information is potentially threatening to the deal.

Get your facts straight

First and foremost, make sure that the data you provided your banker with during the discovery phase of the relationship is accurate. It’s not uncommon for systems to not reconcile because accounting systems and operational systems are often used for different processes and reporting. Still, there should be a rational explanation for the discrepancies, and it should always be footnoted.

CFO

During the “selling phase” of the deal, the CFO’s responsibility is pretty light other than simply reporting on things they typically write on regardless. However, once the LOI is signed, the CFO’s responsibility goes into hyperdrive. Suppose the CFO didn’t correctly plan resources before this phase, their lack of ability to deliver will not only put their job in jeopardy after the transaction, but it will also delay the transaction, casting doubt on the team’s ability to execute.

Sales Traction

The buyer’s valuation and thesis are predicated on the company continuing to perform up to and through the transaction’s closing. A common mistake made in the process is to take your eye off the ball, especially when it comes to revenue. It’s easy to get consumed by the resource requirements of closing the deal. However, if you don’t have a hyper-focus on maintaining your current revenue rate and deliver on projected revenue, the buyer will think that something is systemically wrong with the business. This can kill a deal.

Technology Land Mines

If your business relies on technology or your product IS a technology product, there are several land mines that you must consider addressing before due diligence. If you wait until diligence begins, it will be too late to fix certain things. Many buyers are now contracting with “Technical Diligence” firms like Crosslake Technologies to do technical audits. The buyers recognize that they may be great at understanding the fundamentals of the financing or operations of a business, but technology is an entirely different language. Proactive technical diligence work can mean the difference between a clean closing and a deal getting flushed.

Customer Management

We had a deal last summer that brought this one home. The seller needed to sell for strategic reasons, yet the most significant customer was on the ropes for reasons unrelated to management. Businesses commonly sell for either a multiple of EBITDA (profit) or a multiple of Annual Revenue Rate (ARR). Regardless of which yours is, the loss or threatened loss of a strategic customer relationship will reduce revenue expectations and threaten a deal. At the very least, it will allow the buyer to retrade the deal at a lower valuation. Managing this customer relationship during the selling process is critical to the success of a transaction, especially if customer concentration is a lurking issue.

Hire the Experts

There are as many categories of attorneys as there are businesses. Just because someone has the title and is your friend doesn’t mean they should manage your transaction. I watched a deal almost get killed last fall due to a seller wanting to use their corporate attorney to run the transaction. We emplored them to use a reputable “deal attorney,” but they chose a friend of the corporate attorney who had been with them for years. Ultimately, the choice was a bad one. The mistake cost the seller hundreds of thousands of dollars in extra fees and created a credibility gap for the CEO due to poor judgment and decision-making.

The Tax Man

Several years ago, we were in the process of selling my first business. The deal looked great. A strategic buyer had submitted an LOI, and we were deep into diligence. Everything looked good, except the tax treatment of the deal became a sticking point in the transaction. Ultimately it got resolved; however, it was a great reminder that you need to consider the tax impacts of the deal and how it will affect you and the buyer. An appropriately-sized wealth manager working with a competent tax planner can be worth millions and can head off issues that could cause you to say no to a deal before you ever get there.

Expectations of Management

Nobody likes to be the “bad guy.” It’s also common for people to set optimistic expectations, especially entrepreneurs. The reality is, the process of diligence is stressful for everyone involved. If expectations about this aren’t communicated well in advance, some people may struggle to get through the process, sabotaging a deal. Ensure that everyone who needs to know is well-versed on what will happen in the process so they can plan for it in advance and keep the process on the rails.

At the end of the day, buyers will:

(1) trust that we’ve done our diligence on the company and won’t represent a company that we aren’t proud to represent

(2) trust the company to deliver on it’s promise.

If that trust is violated at any part of the process, the deal won’t get done. Every issue listed above ultimately comes down to trust and integrity in the process.

Want help with guiding the preparation process? A seasoned Investment Banker can help provide valuable insights on how your company can achieve exit velocity.

To arrange a confidential call to discuss how Merit Investment Bank helps companies and their leaders prepare for and achieve exit velocity please call Todd Ostrander, Managing Director @ 253-377-5767 or email Todd.Ostrander@meritinvestmentbank.com

4min

READ MORE

Industry Insights I M&A I M&A Education market

10 Questions For an Ideal Exit – Outlier Outcomes

Most owners of privately held business do not know if their business is sellable or what to do to achieve an Outlier Outcome at sale. An Ideal exit is one that is on your time, your terms and at your price.

In order to help you think about orchestrating your own Outlier Outcome, we offered some tips and observations in our three-part outlier outcomes series.

Companies that achieve “Outlier Outcomes” typically have:

1) Differentiation.

2) High Growth Rate.

3) Consistent Profitability.

4) Defensible Proforma and growth plan

5) Good Positioning.

6) Are in a good “Tailwind” Sector.

Please take a moment to answer 10 questions with a simple yes / no survey to help you get closer to an answer to what is takes to achieve an outlier outcome.

Do you feel you are a leader in terms of growth rate and profits vs. your peers?

Do you have a “rockstar” talented management team and could leave the business at sale without a discount?

Do you know the growth rate of your industry – are you leading, lagging, or neutral to your peers?

Is your largest customer under 15% of sales and your top 3 customers under 35%?

Is your CAC/LTV (or Gross Margin) leading or lagging in your industry?

In a crowded market of Baby Boomer sellers, can you truly articulate why your company is different?

Do you know your business’ value (Have you done a valuation?)

Do you know what number you need to retire or pursue your next chapter AFTER taxes? (Have you met with your CPA & Wealth Manager?)

Do you want to increase the value of your company whether you choose to sell or not?

Are you wanting to achieve a dream exit in under 3 years?

If you answered yes to 8 of the 10 questions above, you are ready for an ideal exit or Outlier Outcome!

If you answered yes to less than 8, we can help accelerate value and help you achieve an ideal or dream exit.

2min

READ MORE

Strategic Advisory I Business Valuation I Exit Planning I Selling a Business I Sell side

10 reasons why now is the right time to sell

Traditional wisdom touts that you should never attempt to “time the market,” but a preponderance of evidence suggests NOW is the best time to sell your company.

1. Economy

Post-COVID, the economy is rebounding. With a 6.6% GDP growth forecasted for 2021, GDP is predicted to return to a normalized historical level in 2022–2023. Companies 5x-20x your size are looking to grow by acquisition and take share. From The Fortune 500 to other competitive middle-market companies, acquisition as a growth strategy is on the mind of nearly all CEOs’ “To Do” lists.

2. Sales Multiples

Quite surprisingly, sales multiples and values have held relatively stable through 2020. More money is chasing fewer “good deals” which is driving up prices for what we call premium companies. Many companies, historically trading in the 4x-6x EBITDA multiple ranges, are now trading for 7x-12x.

3. Private Equity Dry Powder (Cash)

Private Equity has close to $1.5 Trillion in Dry Powder (un-invested funds). Middle-market acquisitions have posted the largest increase in total investible funds raised from 2017 to 2020. With that much money chasing good companies like yours, it is no wonder that sale multiples have remained high.

4. Strategics Stockpiling Cash

Not to be outdone, Fortune 500 and other strategic corporate buyers have historically speaking never had more cash on their balance sheets than now and are acquiring more companies for strategic reasons. Corporations are currently holding over $4 Trillion in cash to acquire target companies. “Buy vs. Build” is alive and well, putting cashback to use vs. distributing higher dividends back to shareholders.

5. Historically Low-Interest Rates Benefit Sellers

Debt is almost always a part of Private Equity and corporate deal structures. Interest rates are at historic lows, and the Federal Reserve’s commitment to keeping them low through 2023 makes the cost of capital lower and M&A returns higher. Therefore, acquirers can afford to pay higher multiples and still achieve their desired ROI or ROIC.

6. Risk Premiums Remain Low Aiding Benefit Sellers

The average market risk premium in the United States remained at 5.6% in 2020 despite the pandemic’s effects on the business community and economy in general. This suggests that investors demand a slightly higher return for investments in the US in exchange for the risk they are exposed to. This premium has hovered between 5.3% and 5.7% since 2011. Favorable US assets, GAAP accounting, and a large Total Addressable Market (TAM) in the US, coupled with the Federal Reserve’s efforts to keep inflation low, make for a strong M&A market in 2021 and beyond.

7. End of Low Corporate & Capital Gains Taxes

With the Biden administration’s promise of a higher personal tax rate and an increase in the capital gains rate, sellers will receive lower net-after tax proceeds from a sale. With the Senate split 50/50 with the democratic tiebreaker, it’s likely taxes will go up and to be the year to sell and avoid these tax increases.

8. Recession Survival

Perhaps having delayed the sale of your firm during the last recession and surviving the pandemic-triggered downturn, you are now weighing if you want to weather another downturn or take advantage of the post-pandemic recovery to sell. IRT Economics (our economic advisor with a 94.7% Forecasted Accuracy) highlights this unique time in our history. “The recession was not a usual, fundamentals-driven business cycle event, so we expect the economic recovery will be unusually robust. Businesses must therefore be opportunistic and seize on the unique elements currently at play. This cycle, the historical ‘recovery playbook’ will not be enough, and that is good news for firms that are willing to adapt to prosper.”

9. Baby Boomer Supply and Demand Issues

A glut of companies will be flooding the market as boomers (the most entrepreneurial generation) look to retire – supply and demand issues will have a real effect on market multiple, favoring only premium companies. In 2016, the first wave of boomers turned 70 (born 1946 – Post-WWII), followed by the successive three waves. Get ahead of the supply and demand curve. Again, you can’t control the fact that more companies will flood the market as baby boomers equate the sale of their business timing with retirement timing (75%), but you can profit from the knowledge of it.

10. Diversification

It is said that most middle-market entrepreneurs have as much as 80% of their net worth tied up in their relatively illiquid private companies. Taking chips off the table, diversifying assets, and reducing associated risk is a wise strategy always, but perhaps more critical now, given the previously unimaginable impact of an event like COVID-19. If 2020 has taught us anything, it is being diversified helps mitigate risk. Who could have imagined the previous hot sectors of Aerospace, Hospitality, or Retail would have taken such a deep hit? Value is measured not only by what you have created but by how you have de-risked your entire portfolio.

The Trifecta of M&A

This list would not be complete if we did not make a note on timing the market and what we call the “Trifecta of M&A.” While our comments above have an air of timing the market, recommending now as a good time to prepare and execute an M&A liquidity event, we are uniquely aware of the Trifecta of M&A, which is where these three conditions align:

Market conditions are currently and should continue to be frothy for the foreseeable future. Regardless of exogenous factors, achieving maximum value for your company requires preparation and continued execution of a rebuilding value plan or growth plan. Achieving exit velocity (growth achieved in the months leading up to a sale) will put more cash on the table for you at closing. In addition to preparing the business for the transition, you must also prepare mentally. For many, the cognitive and emotional shifts experienced throughout the process maybe even more impactful to your life than the transition itself.

Merit Investment Bank’s M&A advisors, investment bankers, and value enhancement teamwork as an integrated partner to help you create, build and grow value, and achieve readiness on all fronts.

When you are ready to exit, in your time and on your terms, our investment bankers can help you accelerate and capture value in a liquidity and exit process designed to meet your personal and business objectives. Why? Because your legacy matters!

Exit Well!

5min

READ MORE

Selling a Business I Sell side I Strategic Advisory I Business Valuation

10 Tips For Selling your Business

As a business owner, the last year has been quite a roller coaster, especially if you have been considering the sale of your business. Perhaps you had even started the process to go to market before the pandemic only to see the deal fall apart as uncertainty shut down almost all transactions. Many businesses went into survival mode for some time and, depending on the industry, may have even been forced to shut down. Others had the great fortune of being in an industry that benefitted from the economic changes or pivoted their business strategies quickly, leaving them in the best financial position they’ve ever experienced.

As the economy begins to open back up and business gets back up to speed, many of you are again thinking more about your financial future and getting back into a position to sell your company.

Other variables that have also been thrown into the mix are the potential tax law changes that could impact your profitability, valuation, and the net amount you keep from the sale.

With all of this noise and uncertainty, you may want to consider a thorough review of both your business and personal financial situation to see if your current strategies will bring you the outcomes expected, with what we call a “Stress Test.”

A Stress Test is a valuable process for business owners and affluent families with more complex financial situations seeking to grow, protect their business, wealth, and estate. A Stress Test can determine whether your financial planning strategies will deliver your desired results in various situations, environments, and current political climate. They can also identify potential mistakes, so proactive changes can be made to achieve the desired result and reach your goals.

A Stress Test is also a good idea if you’re considering an exit strategy. The test ensures you’re working with the right professionals to get the value you want and aren’t on the path to making any potential mistakes. Selling your business is a complex step. A Stress Test will target which areas your buyer will hone in on to negotiate price and allow your team to build a strategy for these areas that may need defending. Having the right deal team in place can make all the difference in getting the outcome you desire. The key members of this team should include your attorney, CPA, wealth manager, and investment banker.

Selling your business can be an overwhelming process and an emotional time. The motivating factor for selling can be as emotional as well. Whether you have built the business, it became tremendously successful, and now it’s time to move on, or if you’ve another venture in mind or perhaps retiring, this can be an exciting and sentimental time. Below are a few tips to help simplify the process that we emphasize in our stress testing process for owners thinking about a transaction:

1. Determine your business value

While a business is generally worth a multiple of its profit, there are a few other determining factors. The size of the deal or the industry can shift those multiples anywhere from 2 to 10 times the profit.

Unexpected circumstances do occur, and if this is a driving factor in the potential sale of the business, the process of selling has just become exponentially more stressful. No matter what drives the sale, the process is time-consuming, and there are several details you can’t afford to overlook.

2. Don’t Do This Alone

No matter your reasons for selling, your first step should be to bring in the experts. Financial, legal, tax, and wealth advisors are essential resources that ensure no detail is overlooked. A cohesive and collaborative wealth management team that has your back will make the process less stressful. It can also simplify and quiet the outside noise so that the end process is more satisfying and profitable.

Choosing professionals with experience in mergers and acquisitions is essential. It might be tempting to first turn to your long-time accountant or attorney, but if they don’t have the experience behind them to negotiate what’s best for you, it hurts only you in the end. Considerations when choosing your team should include:

Integrity

A sense of purpose and deep concern for their clients

Extensive technical expertise

Experience

Every good team needs a coordinator and a wealth manager with deal experience that is often the professional best suited to lead this group. The coordinator knows the client and their needs and brings in professionals with relevant skills specific to each client’s situation. The coordinator also takes care of follow-up and accountability, keeping in constant contact with the client and the cohesive financial team to ensure the highest professional standards are met, promises are delivered, and that the client is happy with the results.

A cohesive wealth management team working together to help you reach your goal will help you jump to the front of the line.

3. Silence is Golden

There are a few reasons to keep an impending sale quiet. Once you have finalized details of the deal, determine how to transition your customers to new ownership. If you release information too early, your customers may go into panic mode, or competitors may be able to swoop in.

4. Be seen, Increase visibility

To increase your chances of finding the best fit, an investment banker is an essential piece of the puzzle to give your business the highest market visibility. An investment banker will also assist you in setting a realistic price and contact potential buyers on your behalf. The best bankers focus on what is best for you, not on the outcome itself, and can make a significant difference in what may be the largest transaction you go through in your life.

5. Be realistic when setting the asking price.

Listen to your investment banker and deal team. It’s tempting to ask for a high price, but buyers will look at many factors when considering a purchase in reality. This is one reason a stress test that looks at all the same angles a potential buyer will see before you go to market is so crucial.

Financial trends, management team readiness, client relationships, and personal investment of time by the new owner to make a successful transition are considerations when setting your asking price.

6. Focus on the paperwork

Before you hang the for-sale sign, make sure all your paperwork is in order. Potential buyers want to peruse everything, including taxes, financials, and existing contracts involving your business. The process will be much smoother if you’re organized. Include financial and tax records for the past three years and a cash flow report.

7. Separate business and personal

Business owners running personal expenses through the business now and then is a common practice. Potential buyers need an accurate and clear view of the revenue, expenses, and net profit of your business. Now is the time to ensure everything is separate and stays that way to the finish line.

8. Get it in writing

Price alone may not be the only factor to consider. In order to make accurate comparisons of multiple offers, it’s helpful to have them in writing with all the terms and conditions spelled out. Recording the details of each offer can ultimately determine which is the best fit for you.

9. First impressions count

If you have a brick and mortar, make sure it’s clean, all necessary repairs are made, and all equipment is in working order. Curb appeal is essential. In addition, make sure your team has prepared for the presentation with potential buyers, including reviewing the likely questions and how you will approach the answers.

10. It’s all in the details

Tie up your loose ends, big and small. Make sure all payments are up to date, and if you’ve promised shares in the company to a team member, the time to take care of this is now. Loose ends can cause potential problems as you’re trying to complete the deal.

This list of tips is not exhaustive; however, it is a good starting point as you consider the future sale of your business.

The key is, you are not alone in this process! Working with the right team will ensure you’re prepared before your business goes to market. You will be set up for success and increase your chances of finding the right buyer and the price.