10 Reasons Why Now is the Right Time to Sell

Traditional wisdom touts that you should never attempt to “time the market,” but a preponderance of evidence suggests NOW is the best time to sell your company.

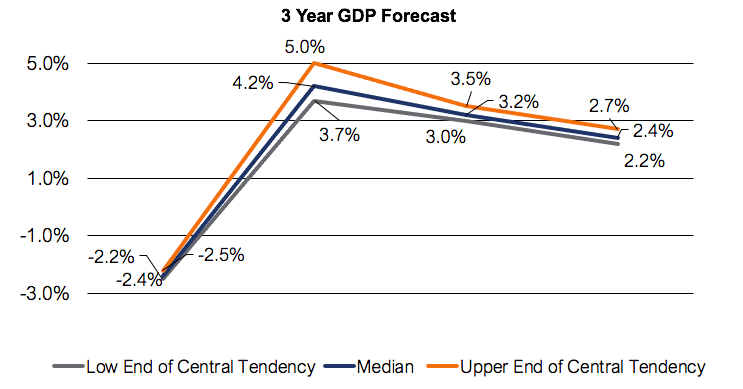

1. Economy

Post-COVID, the economy is rebounding. With a 6.6% GDP growth forecasted for 2021, GDP is predicted to return to a normalized historical level in 2022–2023. Companies 5x-20x your size are looking to grow by acquisition and take share. From The Fortune 500 to other competitive middle-market companies, acquisition as a growth strategy is on the mind of nearly all CEOs’ “To Do” lists.

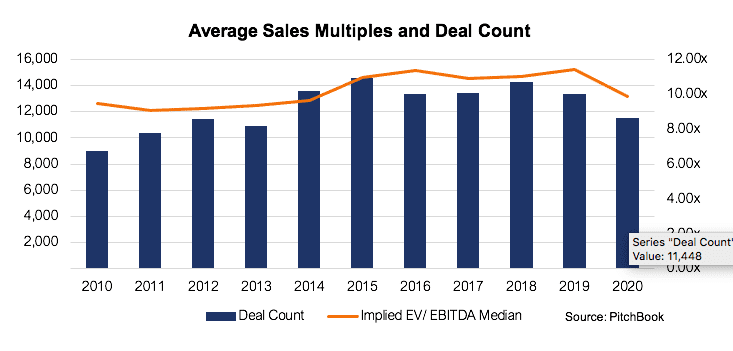

2. Sales Multiples

Quite surprisingly, sales multiples and values have held relatively stable through 2020. More money is chasing fewer “good deals” which is driving up prices for what we call premium companies. Many companies, historically trading in the 4x-6x EBITDA multiple ranges, are now trading for 7x-12x.

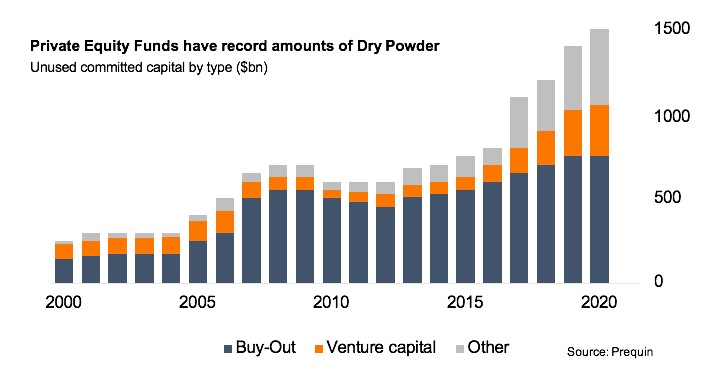

3. Private Equity Dry Powder (Cash)

Private Equity has close to $1.5 Trillion in Dry Powder (un-invested funds). Middle-market acquisitions have posted the largest increase in total investible funds raised from 2017 to 2020. With that much money chasing good companies like yours, it is no wonder that sale multiples have remained high.

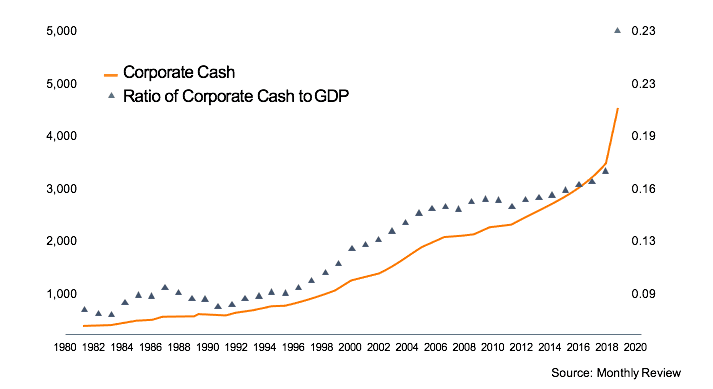

4. Strategics Stockpiling Cash

Not to be outdone, Fortune 500 and other strategic corporate buyers have historically speaking never had more cash on their balance sheets than now and are acquiring more companies for strategic reasons. Corporations are currently holding over $4 Trillion in cash to acquire target companies. “Buy vs. Build” is alive and well, putting cashback to use vs. distributing higher dividends back to shareholders.

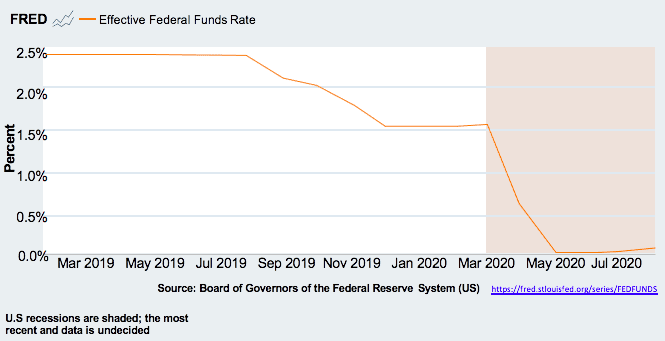

5. Historically Low-Interest Rates Benefit Sellers

Debt is almost always a part of Private Equity and corporate deal structures. Interest rates are at historic lows, and the Federal Reserve’s commitment to keeping them low through 2023 makes the cost of capital lower and M&A returns higher. Therefore, acquirers can afford to pay higher multiples and still achieve their desired ROI or ROIC.

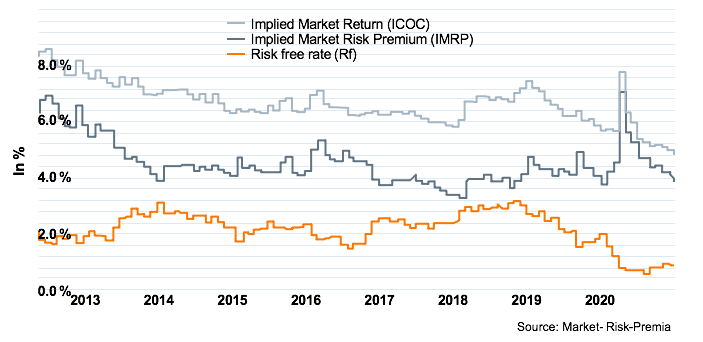

6. Risk Premiums Remain Low Aiding Benefit Sellers

The average market risk premium in the United States remained at 5.6% in 2020 despite the pandemic’s effects on the business community and economy in general. This suggests that investors demand a slightly higher return for investments in the US in exchange for the risk they are exposed to. This premium has hovered between 5.3% and 5.7% since 2011. Favorable US assets, GAAP accounting, and a large Total Addressable Market (TAM) in the US, coupled with the Federal Reserve’s efforts to keep inflation low, make for a strong M&A market in 2021 and beyond.

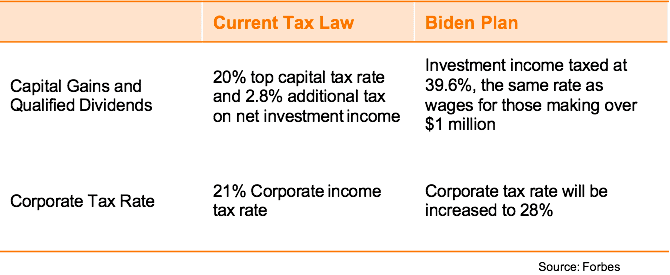

7. End of Low Corporate & Capital Gains Taxes

With the Biden administration’s promise of a higher personal tax rate and an increase in the capital gains rate, sellers will receive lower net-after tax proceeds from a sale. With the Senate split 50/50 with the democratic tiebreaker, it’s likely taxes will go up and to be the year to sell and avoid these tax increases.

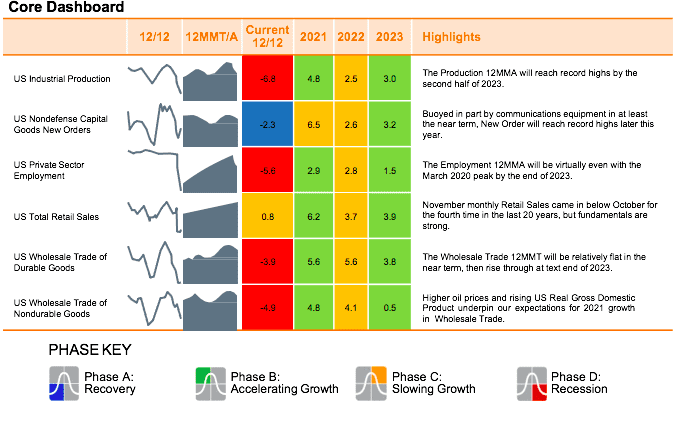

8. Recession Survival

Perhaps having delayed the sale of your firm during the last recession and surviving the pandemic-triggered downturn, you are now weighing if you want to weather another downturn or take advantage of the post-pandemic recovery to sell. IRT Economics (our economic advisor with a 94.7% Forecasted Accuracy) highlights this unique time in our history. “The recession was not a usual, fundamentals-driven business cycle event, so we expect the economic recovery will be unusually robust. Businesses must therefore be opportunistic and seize on the unique elements currently at play. This cycle, the historical ‘recovery playbook’ will not be enough, and that is good news for firms that are willing to adapt to prosper.”

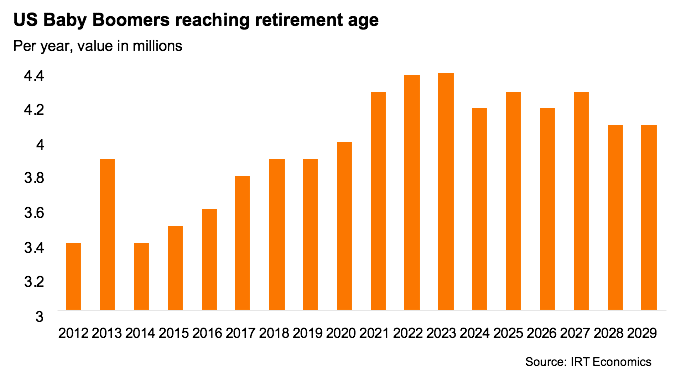

9. Baby Boomer Supply and Demand Issues

A glut of companies will be flooding the market as boomers (the most entrepreneurial generation) look to retire – supply and demand issues will have a real effect on market multiple, favoring only premium companies. In 2016, the first wave of boomers turned 70 (born 1946 – Post-WWII), followed by the successive three waves. Get ahead of the supply and demand curve. Again, you can’t control the fact that more companies will flood the market as baby boomers equate the sale of their business timing with retirement timing (75%), but you can profit from the knowledge of it.

10. Diversification

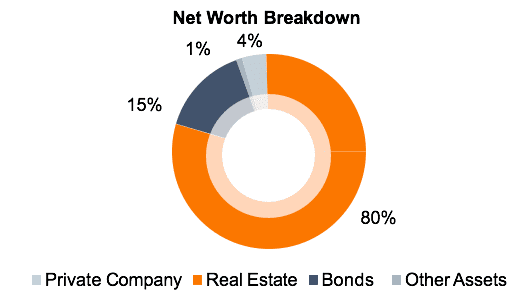

It is said that most middle-market entrepreneurs have as much as 80% of their net worth tied up in their relatively illiquid private companies. Taking chips off the table, diversifying assets, and reducing associated risk is a wise strategy always, but perhaps more critical now, given the previously unimaginable impact of an event like COVID-19. If 2020 has taught us anything, it is being diversified helps mitigate risk. Who could have imagined the previous hot sectors of Aerospace, Hospitality, or Retail would have taken such a deep hit? Value is measured not only by what you have created but by how you have de-risked your entire portfolio.

The Trifecta of M&A

This list would not be complete if we did not make a note on timing the market and what we call the “Trifecta of M&A.” While our comments above have an air of timing the market, recommending now as a good time to prepare and execute an M&A liquidity event, we are uniquely aware of the Trifecta of M&A, which is where these three conditions align:

Market conditions are currently and should continue to be frothy for the foreseeable future. Regardless of exogenous factors, achieving maximum value for your company requires preparation and continued execution of a rebuilding value plan or growth plan. Achieving exit velocity (growth achieved in the months leading up to a sale) will put more cash on the table for you at closing. In addition to preparing the business for the transition, you must also prepare mentally. For many, the cognitive and emotional shifts experienced throughout the process maybe even more impactful to your life than the transition itself.

Merit Investment Bank’s M&A advisors, investment bankers, and value enhancement teamwork as an integrated partner to help you create, build and grow value, and achieve readiness on all fronts.

When you are ready to exit, in your time and on your terms, our investment bankers can help you accelerate and capture value in a liquidity and exit process designed to meet your personal and business objectives. Why? Because your legacy matters!

Exit Well!

0 Comments