Conventional wisdom suggests you should never attempt to “time the market” when making a plan to sell your business. Nevertheless, the preponderance of evidence suggests NOW is the best time to sell your company.

M&A activity has remained very high in 2019 and average sale prices are up, driven by higher multiples, better financing and companies with strong earnings. There is no perfect time to sell, but the conditions are extremely favorable right now and the risks of waiting are growing.

Economic Conditions are Good, Sales Multiples Trending Upward

Despite political turmoil, economic conditions continue to be favorable and there are companies 5x-20x your size are looking to grow by acquisition. From corporate America to other competitive middle market companies, never before has acquisition as a growth strategy been on more CEO’s strategic “To Do” lists in order to find growth.

Sale Multiples and Values are up. More money chasing fewer “good deals” are driving prices up. Many industries historically trading in the 4x-6x EBITDA multiple range are trading for 7x-12x. These numbers are real and values are up.

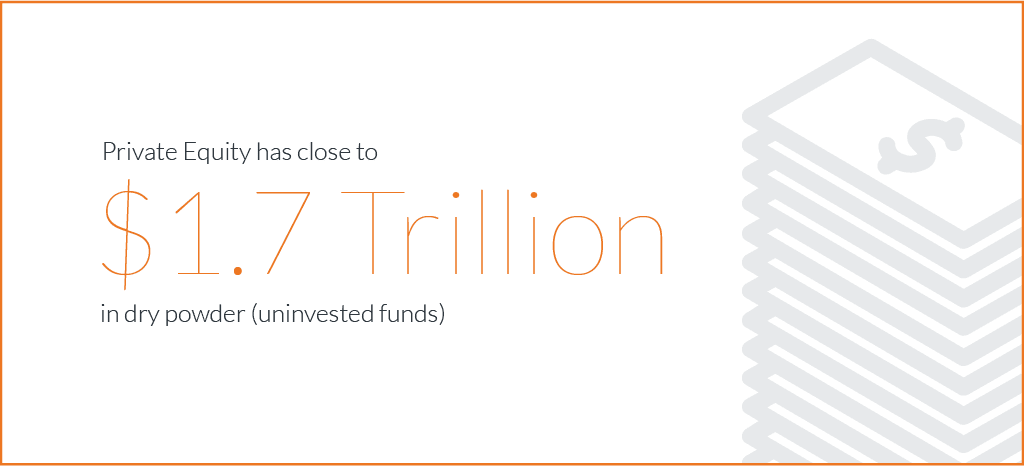

Private Equity & Corporate Cash Is Abundant Right Now

Private Equity has close to $1.7 Trillion in dry powder (uninvested funds) and after taking a break from raising additional funds during the recession, they are now raising even more money as we speak. Middle Market funds have posted large increases in investible funds in recent years. With that much money chasing “good / valuable” companies no wonder #1 & #2 above are happening.

Not to be outdone, corporate America or “strategic buyers” have never had more cash on their balance sheets (perhaps due to the recession, post-recession management discipline, as well as few reasons to invest cap-ex in an anemic growth environment) and are acquiring more companies for strategic reasons. “Buy vs. Build” is alive and well to put cash back to use vs. distributing higher dividends back to shareholders.

Interest Rates Remain Historically Low, But For How Long?

Sooner or later the Fed is going to cut interest rates again and debt is almost always a part of Private Equity and Corporate deal structures.

Despite the political and economic uncertainty going forward, interest rates remain near historic lows and that makes the cost of capital lower and M&A easier and less costly, so acquires can afford to pay higher multiples and still achieve their ROI.

Many, however, sense the coming end of low rates. We advise owners however, to focus on things they can control – you can’t control macroeconomics, however, having read the tea leaves, now may be a good time to prepare for sale and take advantage of this market dynamic.

Is Another Recession Looming?

Well known economist Alan Beaulieu of IRT Economics, one of the nation’s oldest economics consultancies believes that a recession is overdue and may already be occurring. Signs include interest rate hikes, fluctuations and corrections in the stock market, yield curve inversion, trade wars and other factors. If the recession is underway, not selling now could be a significant mistake.

Perhaps having lost value in your company during the recession or having delayed the sale of your firm until the economy improved, you might ask yourself if you want to wait through the next recession or get prepared.

Sell While You Are Still Growing

Growth is still the primary metric by which acquisitions are made. Every company is more valuable if they are growing. If you are growing, you will be more valuable and your multiple of sale will be inherently higher. Fast growth companies trade at higher multiples as shown below in an example of various SaaS companies.

Let Merit Investment Bank & Company Help You Succeed

Merit Investment Bank is a leading Boutique Investment Bank focused on serving middle market companies. They are a client-focused team of experienced entrepreneurs, operating executives, and investment bankers with expertise in a broad range of industries. Merit Harbor, member FINRA / SIPC, is a full-service Broker Dealer licensed in 50 states executing sell-side and buy-side M&A transactions, debt and equity capital raises, corporate finance, real estate development and project finance.

0 Comments