The sell-side M&A process has many layers that require different tactical approaches depending on your business’s unique circumstances. In some ways, no two sales processes are exactly the same. The playing field is a little different with every transaction, so a distinct game plan must be followed.

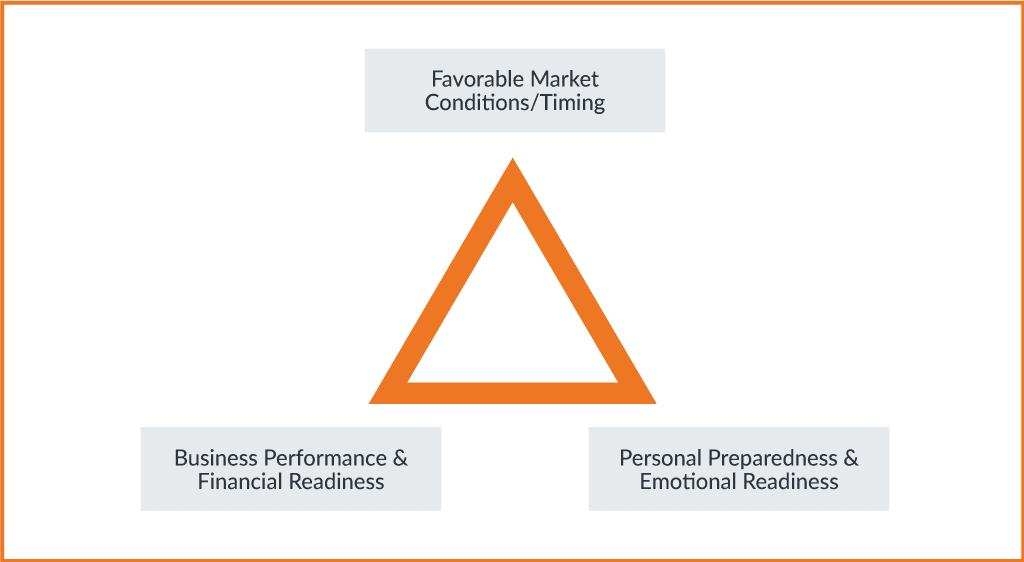

In our experience at Merit Investment Bank & Co., we have found that there are three crucial foundational aspects that must be in place before we can apply a strategic approach to a successful outcome.

When these three conditions align, we call it The Trifecta of M&A:

- Favorable Market Conditions/Timing

- Business Performance & Financial Readiness

- Personal Preparedness & Emotional Readiness

Market Timing

Market timing is the one area of the trifecta that the business owner does not have any control over. The good news is that for most mid-market businesses, the current market is ripe with opportunity, and the general feeling in 2019 is that now is an excellent time to prepare and execute an M&A liquidity event.

According to a 2019 midyear M&A report published by Harvard Law School Forums:

Coming into 2019, dealmakers were cautiously optimistic about U.S. M&A activity despite concerns over mounting headwinds. Almost six months into the year, this cautious optimism seems justified, with activity levels relatively strong on a historical basis, supported by an accommodating environment of economic growth, generally stable equity markets, liquid debt markets, record amounts of “dry powder” and a steady stream of new megadeals. At the same time, a sense of uneasiness has crept into the M&A market as a result of concerns over fully priced assets, monetary policy, trade tensions, market volatility and regulatory uncertainty.

Are You Financially Ready To Sell Your Business?

We have found that there are typically 4 types of entrepreneurs as it relates to financial preparedness and readiness to exit:

Financially which business owner are you?

- Fiscally Fit: Well off. Your future lifestyle is not dependent on the sale of the business.

- Financially Illiquid: Not well off per se (most of worth tied up in the company), but the future of your lifestyle is dependent on a sale.

- Burnt-Out: Financial concerns are secondary / done with day to day. Find me a seller at the highest price – I want out (business is profitable).

- Risk Mitigator: Not well off, and may be feeding the company. You have to sell ASAP to avoid further financial impact (business not profitable).

At first blush profitable exit opportunities may only exist for owners 1 & 2. However, exit events or partial exit events are possible for each of these from a financial standpoint and in-fact given the individual needs of each owner, the exits may look very different for each individual and company. However value can be achieved with the right mental and financial assistance applied to the owner’s desired outcomes.

Although we suspect you will be able to easily identify which business owner or entrepreneur you are in the above list, and even be able to assess your own mental readiness for making the transition, the next step is integrating the two in a cogent assessment of where you are and where you want to be.

In short, even though swinging for the fences may not be in your future you can extract additional value out of your company over time in a planned exit.

Are You Mentally Ready To Sell Your Business?

Entrepreneurs by nature are definitive and driven yet flexible and adaptive to market conditions. These same characteristics allow them to single-mindedly advance their businesses over difficult terrain and rise above adversity while simultaneously having the ability to quickly course-correct and respond to the marketplaces favor or challenges.

Knowing yourself and where you stand both personally and in relation to your role in your business are key drivers to determining your readiness to exit your business.

Mentally which Entrepreneur are you?

Prepared – You have all of your ducks in a row, succession / exit is planned, and you can envision the future without your company.

Enmeshed – You feel trapped and cannot imagine the business surviving without you. The business has become both hobby and lifestyle.

Un-imaginative – You have been too busy working or have made your business so much of who you are that you cannot imagine what you will do if your company sells or you have put off exit planning.

Invested vs. Owned – You measure business on ROI and see exit or keeping the business as an investment vs. a lifestyle or career decision. The business works for you vs. you work for the business.

The good news is that for most mid-market businesses, the current market is ripe with opportunity.

The degree to which you can be mentally prepared and keep the time table of decision making within your control, is the degree to which you can realize the fruits of your life’s work.

Alignment of the mental and financial considerations can make for an integrated and rewarding exit, or a painful reality if one is not balanced with the other.

0 Comments