Given the current state of markets, the most common inquiry we hear (not surprisingly) is, “Is now still a good time to sell”?

Great question.

Historically, the middle market has often been insulated from the volatility of the SMB and public markets, repeatedly displaying resiliency and consistency over the long term. Let’s consider some empirical evidence of this phenomenon even today.

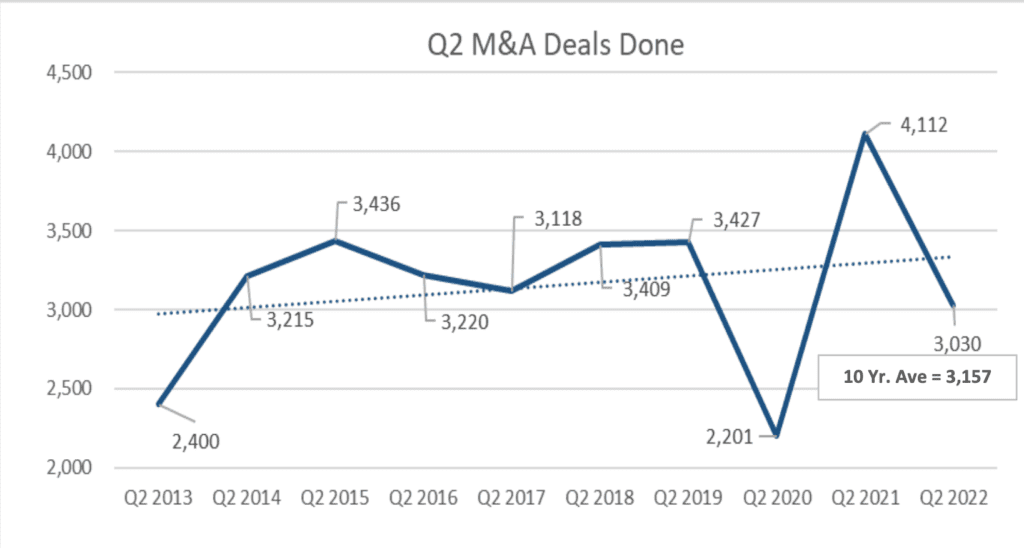

While 2021 was a record year for M&A by all accounts, many believe, mistakenly, that record year marked a “new normal.” But is that really the case? It is critical we ground ourselves in historical data to gain perspective.

Many industry experts broadly characterize the middle market as the “economic engine of America” because of its impressive growth record and consistent returns as an asset class for investors. This is why private equity tends to flock to purchase private middle-market companies. As advisors to middle-market firms, we pay close attention to these trends. We also stay current with relevant data about the middle market, and equally with the prevailing sentiments of CEOs and entrepreneurs running those firms, as they often lead the general market in several ways.

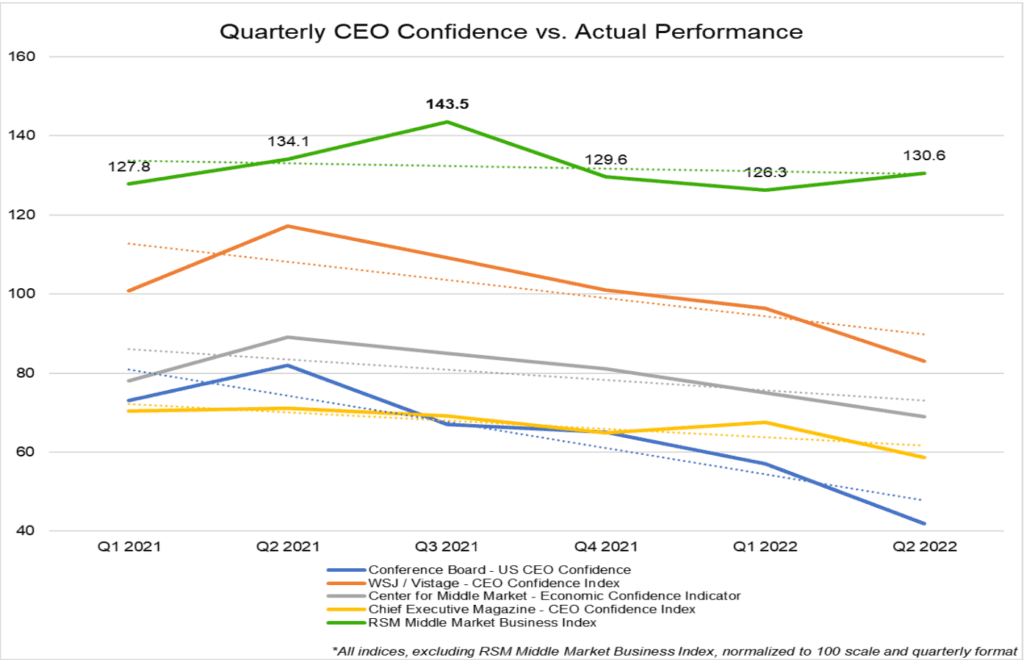

To illustrate our active process, see below four (4) CEO confidence indexes we track at Merit Investment Bank (normalized to a 100-point scale) in order to keep our finger on the pulse of middle-market climate. You will also see a measure of actual middle-market company performance as measured by the RSM Business Index over the same period (green line).

What you will notice is that actual company performance and trendlines are much more robust than the confidence CEOs have in the general economy and its effect on the businesses they run. The point is that the overall economy “confidence” as reported does not always correlate to performance.

Smart CEOs take stock of macroeconomic trends they cannot control and adjust their plans accordingly. Equally, many CEOs take advantage of these times to make bold moves and place big bets to leapfrog their competitors during times of uncertainty.

Middle Market CEOs Bet on Themselves

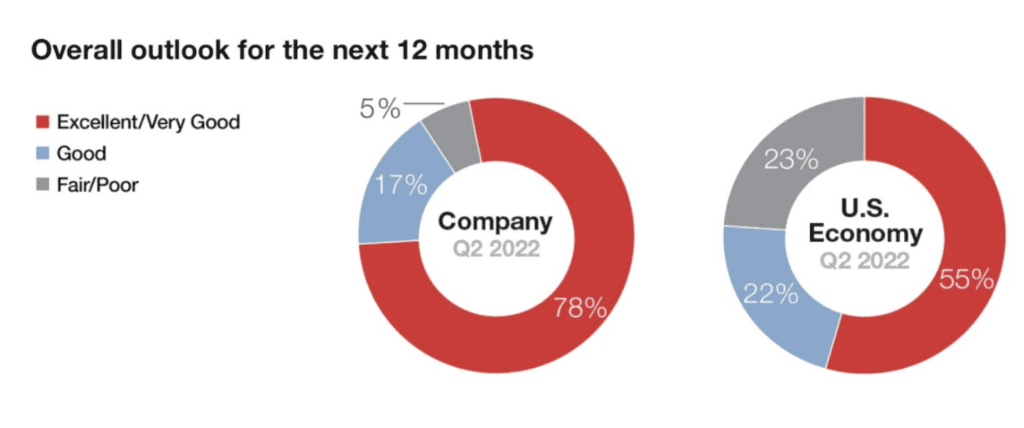

Compared to the news, stock market volatility, and the general economy, the middle market is generally quite bullish on its own performance vs. the overall U.S. economy. The latest KeyBank Market insights survey highlights this difference in outlook for the next 12 months:

While there is no doubt the public markets have been hit hard and economic conditions are nowhere as rosy as they have been, we believe that deals are currently available, and are even now being made for excellent middle market companies. The middle market continues to be the engine that drives commerce in America and is willing to bet on its own performance.

And ,while you cannot always control the macro environment, you can control whether you will stand out in an otherwise perhaps thinner field of sellers.

M&A – Good Time or Bad Time to Sell?

With all this in mind, sellers should be cautiously optimistic. Even though the Q2 deal counts are down from 2021, they approximate the historical norms. The 10-year average of deals completed in Q2 is 3,157, slightly above Q2 2022’s completed deal count. This indicates the market has corrected and achieved a near-term form of equilibrium, approaching the 10-year average for Q2 deals completed. And, while CEO confidence and economic issues remain blunted, we shall see how deals progress through the remainder of 2022. Click here for a deeper dive into the state of M&A markets Q2 2022.

The Flight to Quality and Outlier Outcomes

In challenging and uncertain times like these, investors tend to become more conservative, and a “flight to quality assets” often ensues. To arm themselves for this possibility, would-be sellers should take a serious look at their companies. We recommend they solicit an opinion from their investment banker on ways to further de-risk their companies, solidify future streams of cash flow, and maximize value acceleration, ensuring they will be a good fit for buyers seeking “market-leading” companies.

We also recommend they focus on the following areas to ensure they stand out among their competitors:

- Clearly articulated differentiators (Market / UVP)

- Historical revenue growth above their peers (Sales and Marketing Performance)

- Historical EBITDA growth/margins above their peers (Financial and Profit Performance)

- Fully staffed and capable management team that will stay on after a transaction (Management Team)

- Investment in a defensible growth and expansion plan (Strategic Sales Process and Execution)

- Great positioning and a well-crafted story that is compelling to investors (Customer Journey, Sales Process, and Defensible Proforma)

- Preferably in a good tailwind sector (Refined ICP and Positive Macro Growth Prospects)

Bottom line: Deals get done in all markets and middle-market sellers are very desirable in up, down, or flat markets. Focus on the things you can control, and outperform your peers, and there will always be buyers for your firm.

Exit Well!

To gain additional insights into when, how, and for how much you could sell your business, connect with a Merit Investment Bank banker today. Craig.Dickens@meritinvestmentbank.com | 253-370-8893

Craig Dickens, CEO Merit Investment Bank

Craig is responsible for setting the firm’s vision, creating a culture of boutique personalized service, and recruiting experienced investment bankers to build the Merit Investment Bank team nationally and internationally. Mr. Dickens has advised many leading companies and participates on several middle-market company boards.

Having participated in every kind of business dynamic from start-up to IPO, merger to dozens of acquisitions in his own entrepreneurial career, Mr. Dickens serves clients by guiding them to strategic growth, business optimization, and profitable exit.

Merit Investment Bank is a leading boutique investment bank focused on entrepreneurial middle-market companies. Merit Investment Bank executes sell-side M&A, buy-side M&A, capital advisory services, debt and equity capital raises, corporate finance, and valuation services. Merit Investment Bank delivers award-winning performance and boutique Investment banking services for middle market clients. www.meritinvestmentbank.com

0 Comments