Most business owners follow a recognizable leadership evolution during the lifecycle of their companies. They start by working for their business—doing everything from sales to service. Then they shift to working in the business—managing teams, overseeing operations, and scaling. Ideally, the journey culminates in working on the business—focusing on strategic growth, scalability, and, ultimately, transferable enterprise value.

Unfortunately, too many middle-market CEOs and entrepreneurs never fully transition to that final phase. They remain stuck in the trenches—trapped in day-to-day execution—and when the time comes to consider an exit, they’re often unprepared and under-optimized.

From Survival to Scale – But Not Always to Sellability

In the early days, survival dominates the agenda. Founders focus on product-market fit, scrappy growth, and customer retention. As the business gains traction, growth becomes the focus—and consistent revenue fuels that journey. But this phase can become a hamster wheel, with the owner at the center of everything: sales, operations, innovation, and HR.

That’s where most entrepreneurs plateau.

They’ve built something real, sustainable even, but not necessarily transferable. They may have built income—but not wealth. Without making the leap to an investor’s mindset, many owners risk owning a business that is simply not investable by third parties.

A hard truth:

You can “make it” as an entrepreneur—without ever creating anything truly sellable.

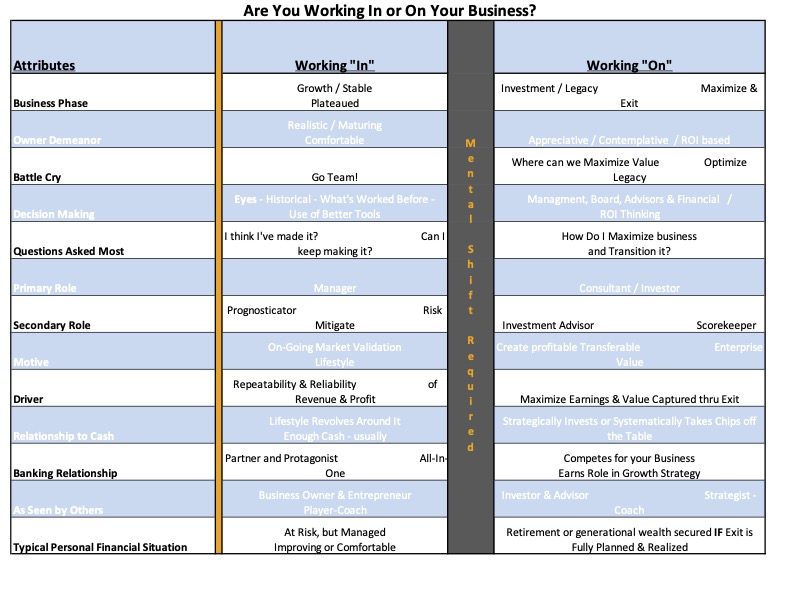

The Mindset Shift: From Operator to Investor

Even owners of successful, profitable companies often fail to make the essential shift in mindset. They never evolve from being the key operator to becoming a strategic investor in their own business. That evolution is critical to achieving a high-value exit.

If you want your company to be attractive to strategic buyers, private equity, or family offices, the internal question you must constantly ask is:

“Am I working for, in, or on my business today?”

Investor-Minded CEOs Think Differently:

- They evaluate decisions based on ROI and long-term value, not short-term tasks.

- They focus on building a scalable infrastructure that can thrive without them.

- They identify and systematically de-risk the business for a potential buyer.

- They compare performance against external benchmarks, not just last year’s results.

Why Benchmarking Against Peers Matters

One of the most common blind spots for owners is measuring progress only against internal historical performance: last quarter, last year, or budget. That’s important—but not how investors think.

Buyers—especially private equity and strategic acquirers—are comparing you against a broad landscape of investable alternatives.

For example, you might be proud of growing 5% year-over-year. But if your sector is growing at 10% to 15%, you’re underperforming the market—and buyers will see that.

Take the Managed Services Provider (MSP) sector: If your MSP is growing at 20%, but the industry is averaging 30%, you’re actually behind.

This is where a qualified investment banker comes in. A banker can not only tell you how you stack up against your competitors, but also shape your narrative around areas where you’re outperforming, crafting a compelling and differentiated positioning strategy for your company.

Outlier Outcomes Require an Outlier Mindset

If your goal is to achieve an outlier outcome—a premium valuation, multiple offers, and a clean exit—you need to start now by embedding the traits buyers value most:

Revenue Growth: Is your CAGR at least 10% above industry average?

EBITDA Performance: Are your margins optimized and growing faster than competitors?

Leadership Team: Can your company operate without you? Will the core team stay post-transaction?

When all three of these factors are present, and the owner has transitioned into a seller’s mindset, businesses consistently trade at higher EBITDA multiples and more favorable deal terms.

And here’s the kicker—when the business doesn’t depend on you, you get to walk away (or participate selectively post-close). Without that, you risk being “handcuffed” to the business long after the transaction.

Building a Business That Buyers Want

To attract the right kind of buyer, you must turn your company into a predictable, de-risked, and scalable investment vehicle. That means:

- Auditing and professionalizing financials

- Implementing repeatable, documented processes

- Retaining key customers and reducing churn

- Developing succession plans and operational redundancies

- Aligning compensation with performance at all levels

Ultimately, it’s about building a business that works without you—because that’s what buyers want.

From Passion Project to Exit-Ready Asset

The transition from passionate founder to investor-minded CEO is not easy. It requires humility, strategic focus, and a willingness to let go of control. But the reward is enormous: freedom, wealth, and the ability to choose your next chapter on your terms.

At Merit Investment Bank, we specialize in helping entrepreneurs and founders like you position their companies for premium exits. Through our Value Enhancement Services, Sell-Side M&A, and Readiness Assessments, we guide business owners in making the shift from building a good business to building a great exit.

Let’s Talk About Your Next Move

If you’re ready to start thinking like an investor and not just an operator, we can help.

Set up a meeting and talk with the experts!

J. Craig Dickens

Chairman

Craig.Dickens@MeritInvestmentBank.com

253-370-8893

Securities offered through Finalis Securities LLC Member FINRA/SIPC. Merit Investment Bank and Finalis Securities LLC are separate, unaffiliated entities.

0 Comments