Are You a “BoomPreneur”? The Roadmap to Transitioning Your Business Successfully

Attention, Boomer Entrepreneurs: Have You Thought About Your Business Exit Strategy?

As a BoomerPreneur, you’ve spent decades building your business from the ground up, watching it grow, evolve, and weather challenges. Now, you’re standing at a pivotal crossroad: How do you transition your business, secure your financial future, and ensure that your legacy endures?

You’re part of the most entrepreneurial generation in U.S. history—Baby Boomers are responsible for more than 4 million businesses, employing nearly 50% of American workers. But, just like the world around us, things have changed. We’ve seen it all: multiple recessions, a global pandemic, and now a “growth recession” that’s impacting the business world. More than ever, Boomers are questioning whether their hard-earned wealth from their business will carry them into a fulfilling retirement. If you fit this description, keep reading because it’s time to ask: Is it time to sell?

The BoomerPreneur Legacy: Why 2023 is Key for Business Transition

By 2023, the youngest BoomerPreneurs will be in their late 50s, and the wave of business transitions is set to increase. The Boomer Retirement Wave is approaching, and as the largest generational group in business today, Boomers will begin to face tough questions: Will younger buyers be interested in “traditional” businesses? Will they understand the value of the companies you’ve spent your life building?

The sad truth is that only 20% of Boomer entrepreneurs will successfully exit their business through an M&A deal, leaving the remaining 80% to struggle with finding buyers or receiving fair value for their hard work. But why?

The Supply and Demand Struggle for BoomerPreneurs

The principles of supply and demand are coming into play, and they are directly affecting BoomerPreneurs. With a large number of Baby Boomers seeking to retire or transition their businesses at the same time, the market is becoming flooded with businesses for sale. When supply increases without enough demand, prices naturally fall. This could impact the valuation of your business and make it harder to achieve the retirement income you desire.

Furthermore, the capitalistic axiom that “all costs drive toward zero” means that unless your business stands out, it’s likely that newer, tech-driven businesses will dominate the market. Disruptive technologies could further reduce your company’s value if you haven’t updated or reinvigorated your business in line with market trends.

The BoomerPreneur’s Dilemma: When is the Right Time to Sell?

If you’ve been holding off on selling your business, waiting for post-pandemic recovery or the right market conditions, you’re not alone. Many BoomerPreneurs have postponed the sale of their companies, hoping to recapture lost value. But with a glut of businesses entering the market and new technologies on the rise, now may be the time to ask yourself:

- When is it the right time to exit?

- How can you ensure your company is ready for a sale and attract the best price?

- Are you comfortable with the risks of holding on for too long, especially if the next recession is on the horizon?

Seizing Your Window of Opportunity

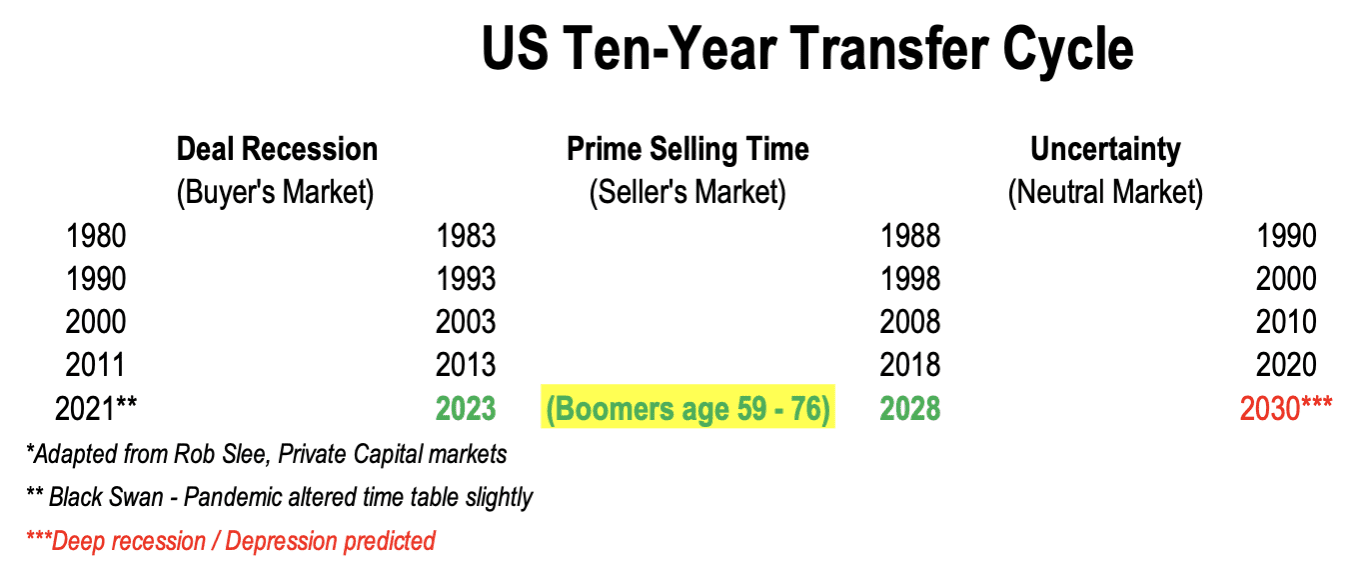

Economist Rob Slee’s Transfer Cycle Analysis suggests that the window for BoomerPreneurs to transition their businesses effectively is a five-to-six-year window, depending on post-pandemic market recovery. For Boomer entrepreneurs who have seen their company value decline or plateau during the pandemic, this window of opportunity may be shrinking.

Furthermore, economist Alan Beaulieu’s predictions indicate that the next major economic downturn—possibly even a depression—could arrive around 2030. The clock is ticking for those hoping to secure a solid exit strategy before these larger, uncontrollable economic factors come into play.

Key Questions for Boomer Entrepreneurs Considering a Sale

As you evaluate the timing for your exit, here are a few questions you should ask yourself:

- How soon do you need or want to transition out of the business?

- Can you still achieve the profit margins and multiples you need to secure your retirement income?

- What are the risks of waiting for the market to improve further?

- How much control do you want over the timing and structure of your exit, regardless of external market conditions?

As middle-market companies are less influenced by the swings in the public market, the good news is that you may not sell too early. However, by preparing ahead of time, you could find yourself among the first to capitalize on the BoomerPreneur transition wave—a key advantage when demand is high and competition is lower.

Actionable Steps to Ensure a Successful Business Transition

- Get Your Business Ready for Sale: Begin by improving operational efficiencies, implementing new technologies, and cleaning up financial statements. Buyers are looking for businesses that are well-prepared and show consistent growth potential.

- Understand the Market Trends: Keep up with the latest trends and evaluate how your industry and company stand in relation to new market disruptions. Whether it’s tech innovation or changing consumer preferences, positioning yourself ahead of the curve could significantly increase your company’s value.

- Work with a Trusted Advisor: Consulting with a professional advisor or M&A expert can help you understand the current market landscape and craft a tailored exit strategy that meets your specific goals.

- Don’t Wait for Perfection: Often, waiting too long for the “perfect” market conditions means missing the ideal window. By acting now, you can control the terms of your sale instead of reacting to external pressures.

Conclusion: Embrace Your Legacy and Secure Your Future

As a BoomerPreneur, you’ve already proven that you’re a fighter. Now it’s time to seize the opportunity and transition your business on your terms. Whether you’re looking to retire comfortably or pass the baton to the next generation of entrepreneurs, the window for a successful exit is now.

Start planning your exit strategy today. Don’t wait until it’s too late to secure the retirement you deserve.

Contact Merit Investment Bank today to learn more about how we can help you transition your business with a tailored M&A strategy, ensuring that you exit on your own terms.

Talk to the Experts at Merit Investment Bank

J. Craig Dickens

Chairman

Craig.Dickens@MeritInvestmentBank.com

253-370-8893

Securities offered through Finalis Securities LLC Member FINRA/SIPC. Merit Investment Bank and Finalis Securities LLC are separate, unaffiliated entities. reserves the right, to the extent permitted under applicable law, to monitor electronic communications. By messaging with Merit Investment Bank, you consent to the foregoing. If you believe that you have received this email in error, please advise the sender by reply email of the error and delete this email immediately.

0 Comments